The PLG for Sales-Led Guide

How to *actually* do and understand it.

If we talk about why anyone entertains exploring product-led growth then it’s usually for one of two reasons:

You want to understand it better because the superficial implementation advice you usually deal with seems not to apply to your sales-led organization

A market opportunity has been discovered by usually expanding downmarket but you’re not sure how to do it. Your expertise is probably mostly in Sales-led distribution and you’re not even sure where to start.

Fundamentally, product-led growth involves a different customer experience with less control due to enhancing its self-serving capabilities. The counter-intuitive thing about PLG (product-led growth) is that it shifts the way you “control” ultimately from obsessing over process control to quality control.

We can only differentiate ourselves if our product IS better and we let the customer make their decision themselves without any chance to have a say in it.

I position myself specifically to address this pain point for sales-led companies because they have usually few conditions in place to pull it off. Oftentimes we need to have a conversation on how to do good, basic product management.

The following guide is based on my passion for organizational building, scaling, and consulting with dozens of sales-led companies that wanted to expand with product-led growth. (If you want to work with me check my “Work with me” Section)

Table of contents

Free Section

1. What IS product-led growth?

2. Sales-Led vs Product-led Growth

2.1 Implementing

2.2 Buy-In

2.3 No free consumer version in sight

3. A de-risked 5-step plan for a successful PLG Distribution

4. Inventory: Dissect our existing value and Market

4.1. Moment to Monetize

4.2 Analyzing your current product (optional)

5. Redefine: The definition of “Product”

6. Focus: Find 3 ICPs and their 4 success signals

6.1 ICPS

6.2 Good & Bad ICPs, Examples

6.3 Customer Success Signals

6.4 Is plg for us? Cross-Roads

7. Measure

7.1 Data & Visibility

7.2 Split revenue reporting

8. Implement: Goals & Org changes

8.1 Growth Teams

8.2 Goals

9. Product-Led Sales

9.1 Deal Qualification

9.2 Product Qualified Accounts

9.3 Product-Qualified Leads

9.4 Expansion Qualified Accounts

9.5 Sales Ramp-Up and Incentivization

9.6 Product-led Sales Example Sunrise

9.7 More PLS Resources

Paid section

10. Common pitfalls

10.1 Treating collaborative environments as “Optional”

10.2 Ignore Data and replace it with “common sense”

10.3 Not doing product-led OKRs

10.4 Scaling product-led sales resources too fast

10.5 Mishandling Sales Incentivization

11. Unexpected Allies

11.1 Using a downmarket segment to build for an upper market

11.2 Unexpected expansion revenue

11.3 Payback Periods as health metrics for PLG

12. Tooling & Resources

12.1 PLG Blogs

12.2 PLG Analytics tooling

1. What IS product-led growth?

I have an extensive guide on the topic linked at the end of this chapter, so let’s keep this very brief:

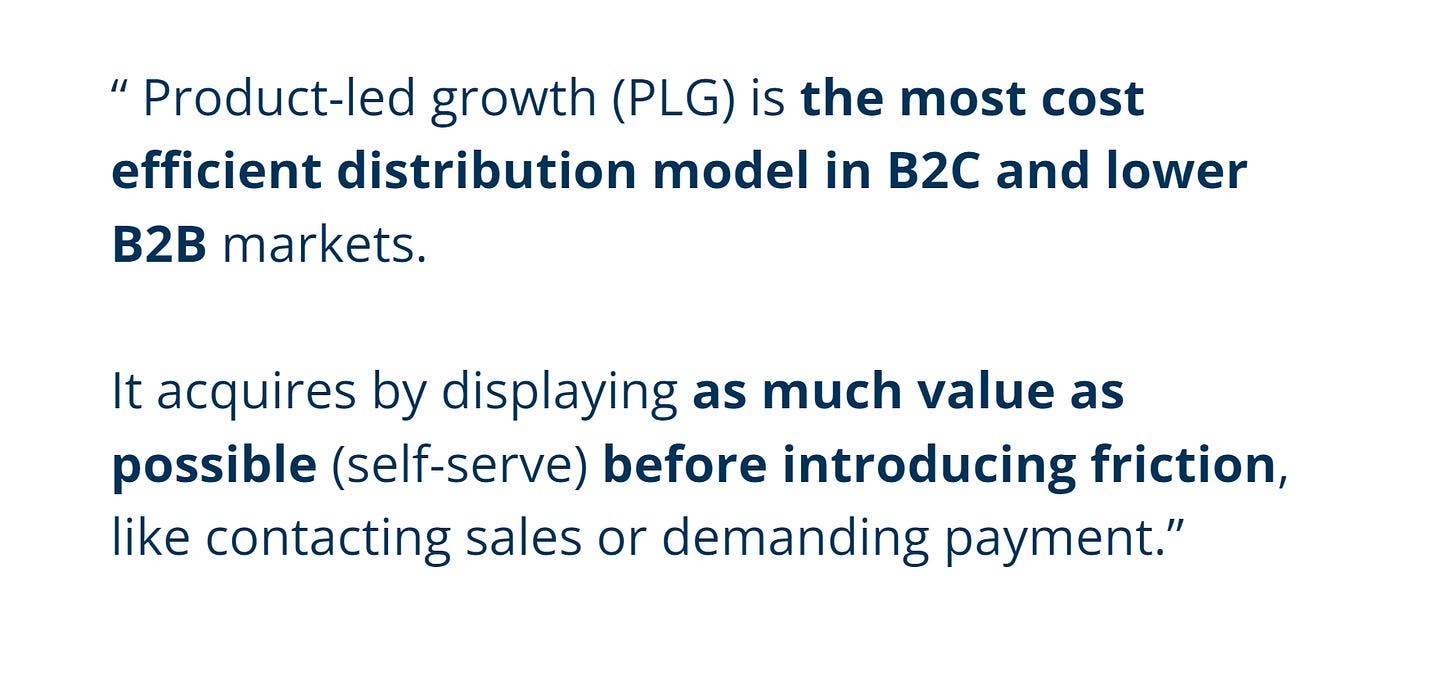

In its purest form, product-led growth is one of many distribution models you can use to reach your users.

This transparent model places the product - what your customer values - at the front and center of your sales and marketing efforts. It depends on the product itself to do the selling by way of its features, performance, and use cases.

Display as much value as humanly possible to your users before guiding them towards any human interaction, like sales or demand payment.

In the right conditions, this is THE most cost-efficient method we know of to acquire users in a given market segment. Focusing on low friction, it’s a defendable moat that keeps you floating above companies that only acquire users through high CAC-related models like a sales-led approach in segments that can be addressed by both.

It has the best Go-to-Market fit the more potential users you can reach

Product-led growth blurs the line between product & distribution. It offers an alternate set of conditions to measure and understand customer value by - one that feeds back into development.

Optional reading for more B2C focus:

2. Sales-Led vs Product-led Growth

There is a problem painting product-led growth to be superior to sales-led growth. Both distribution models are inherently different and address different parts of their markets.

Putting one above the other ignores reality for most businesses: you cannot just abandon your core market to make everything self-serve. It doesn’t work that way.

So… is product-led growth for you? Well, you are reading this guide which means you might consider it. Unfortunately, the answer is a bit more complicated.

Let’s understand the underlying mechanics first, then develop a plan with as little risk for the business as possible in case it does not pan out. And if it does, we decide whether we fully commit to it through product-led sales.

2.1 Implementing product-led growth

Adding Product-led Growth to a Sales-led company is risky and counterintuitive. It's easier the other way around:

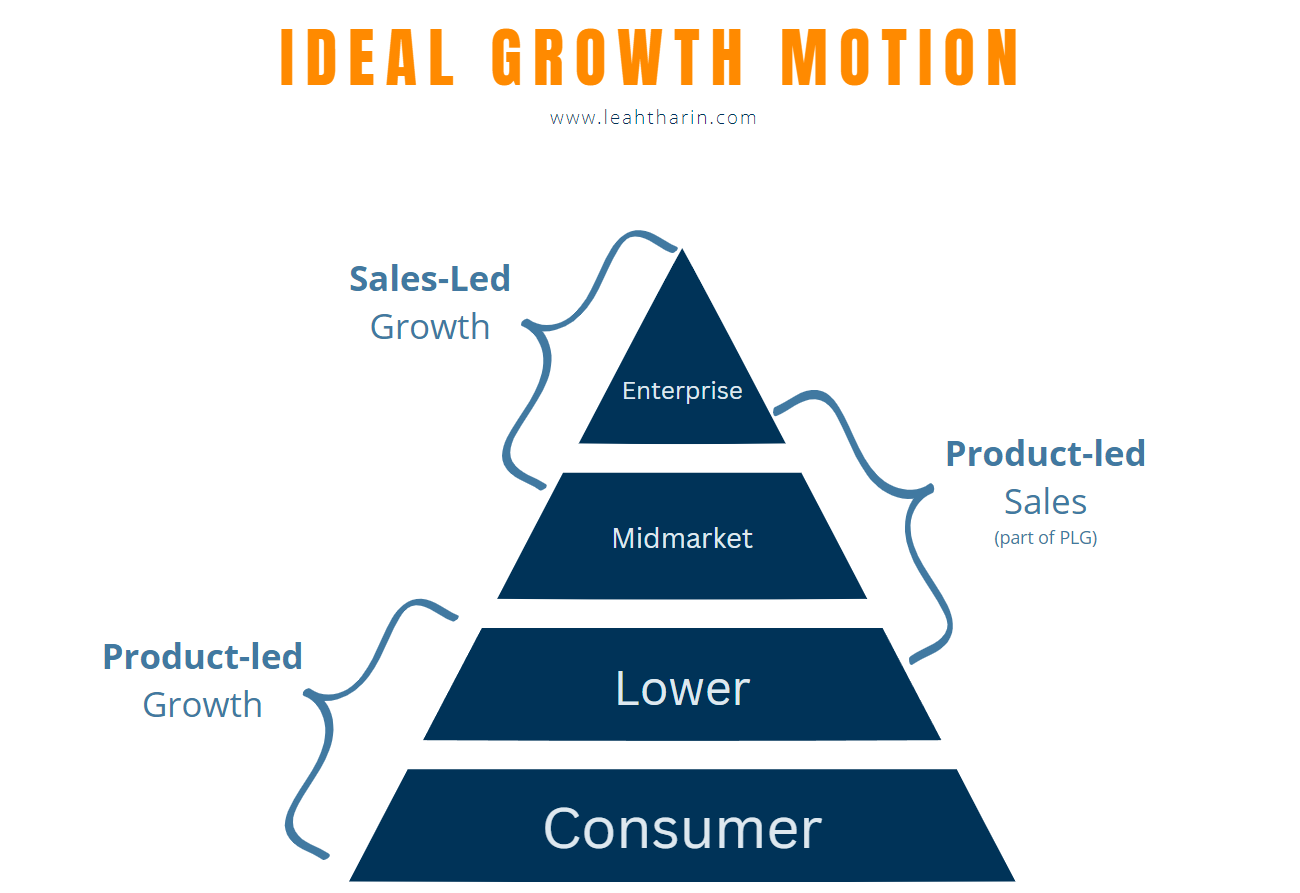

If we oversimplify what product-led growth (PLG) is then it's about self-serving value. We can access a customer segment that is not accessible by sales with little cost. Lower-lifetime value, self-onboarding customers.

Sales-led growth on the other hand is great at closing customers that cannot self-serve. PLG has no good fit there.

In between Sales-led growth (SLG) and Product-led growth (PLG) sits Product-led Sales (PLS) connecting both.

PLG: Low LTV, High Qty

PLS (subfunction of PLG): Medium LTV, Medium Qty

SLG: High LTV, Low Qty

2.1.1 The term “Product-led Sales”

While Product-led Sales is ultimately what we are trying to implement it’s important to understand the inner workings of product-led growth as a whole. This guide aims to cover this important gap.

Product-led Sales is a subfunction of product-led growth and not an isolated thing. For simplicity, we can just call it product-led growth if we understand that it addresses customers much closer to an enterprise segment than what people traditionally understand with plg.

Product-led sales (PLS) leverages customer signals and data to enrich deal qualification to identify long-term revenue before the customer even pays. This drives down our CAC, Cost to Serve, deal cycle times, and most importantly payback period.

2.1.2 The easy way: moving upmarket from B2C

For a classical product-led growth company, it makes sense to move upmarket bit by bit. You can use your existing understanding of user engagement to start gathering leads and qualify them.

That's a straightforward way to product-led sales. It's a natural expansion of your LTV. We target team use cases and slowly redefine what we understand with retaining our users. We have a lot of leads and qualifying makes sure we don't waste the time of our first sales hires.

These medium LTV accounts need to be found and our tracking makes sure of that. It’s a targeted approach from the get-go.

If we manage to close those we might get the odd High-value client that is entirely served by sales almost alone. We expanded slowly and moved upmarket bit by bit. We hired one or two salespeople and started gathering leads through forms.

But…

2.1.3 The hard way: Adding going downmarket as a Sales-led Business

For a sales-led growth business in the reverse case, the story is more complicated. The reason is that product-led sales require more things to change for a sales-led organization than for a classical B2C company starting to layer in sales.

You cannot qualify leads based on engagement if you don't understand your individual users well and what makes them care.

You may not have solid user research processes or enough clients to toy around with lots of data.

You have on one hand high-value accounts and now start to add lower-value self-serve customers. This triggers the fear of CAC staying stable (or even increasing) while ACV decreases. This fear is unfounded as we will explore later on.

This stretch is counterintuitive and uncomfortable for most companies. You have to trust that there is something good coming from it and it may take multiple quarters on top.

To make matters worse, you have to hire people like me (a subset of PLG experts) or entire growth teams which most companies don't know how to handle. Especially if they never measured user engagement and have a product that never dealt with it.

This is inherently more difficult than just adding 1 or 2 more salespeople.

That's why this is so difficult for most SLG companies. This is not SLG vs PLG. It's how to bring them together. An important tool for this is product-led sales.

The good news is, this is highly defendable for classical sales-led markets and a prime tool to disrupt your competition.

Let’s understand why properly:

2.2 Buy-In

Product-led Growth is not a product initiative. It’s also not a sales or marketing tool. It’s a company initiative. There are a couple of reasons for it:

It takes longer than you think. It’s not just adding a self-serve motion to your product, it’s about a fundamental shift in what “customer success” means, and how to operationalize and make everyone’s life better. This takes time. Sometimes more than a year.

It requires compromises in sales, product, and marketing. You might even add a new function to your company. “Growth” Teams. Naturally, other silos might feel threatened by those:

Product: Are they starting to change our product?

Sales: Are they messing with how we sell?

Marketing: Are they changing how we acquire?

Data becomes paramount. Data is very rarely its own function but serves multiple functions. Yet it is essentially nonexistent outside of core sales reporting when it comes to user engagement data. Building this costs time and expertise that might not be present.

I advise people who are starting out in product-led growth to not mention product-led growth too much. Especially in Sales-led companies, there’s a triggered fight or flight risk because they think it’s just hype.

We can show and prove value to the company without having to rely on buzzwords.

2.3 We cannot make a free consumer version of our product!

So much for the theory, in reality, most businesses cannot create a consumer version of their product for various reasons.

But there is almost always a simplified version that allows us to address more of our markets even if it’s just a mid-market segment. Whatever it is in the end, we need to make sure that we include a market where the amount of potential customers is technically too much (or too expensive) for our sales pipeline to deal with.

If we have too many deals with too little LTV attached to we need to qualify them to make them worth it. This is where product-led sales shine.

The goal is to have some version of your product that attracts so many customers that the differentiating factor is becoming to know exactly who you can close before you call them.

You also have to stop thinking about PLG and Enterprise markets as being separate. Over the longer perspective, it is common that some of your low ACVs are starting to expand into enterprise accounts with time.

Even if you discount all that, PLG is a strong driver for taking the guesswork out of product management.

We talk about unexpected allies like expansion revenue and product data in section 11. Unexpected Allies

3. A de-risked 5-step plan for a successful PLG Distribution

Even if you don’t manage to go the full nine yards you’re left with something valuable if done right.

My 5-step process for sales-led businesses I use progressively introduces higher risk but also certainty as we go along:

Inventory: Dissect what works and doesn’t in your value proposition

Redefine: Change what “product” means for marketing, sales, and growth.

Focus: Define ICPs and ignore the rest

Measure: Lay the groundwork to measure what you defined and analyze what you have

Implement: Teams, Goal Settings, Strategy

If you look at product-led growth and product-led sales as a business case it tends to work best. We don’t need to blindly trust the promises of thought leaders like me but can check our insights along the way. And if we decide to not go for it, we still have something useful in place.

4. Inventory: Dissect our existing value and Market

We’re assuming for this particular exercise that you know already in which market you want or are already participating. We start at the end of a great product cycle:

4.1 Analyze the best moment to monetize

Product-led Growth is more often than not an exercise for sales-led organizations to understand when to monetize.

If we simplify the journey of a user all the way up to maturing into an enterprise account it looks something like this:

Users transform from users who are ready to use to those that understand the value, eventually seeing extended value or developing a habit. Those have a chance of becoming teams. Further down we talk about teams of teams and enterprise accounts.

It’s better to monetize as late as possible because of three connected effects:

Virality and Word of mouth: Monetization (Sales or Paywalls like trials, and freemiums) introduces friction, the lower this friction is, the more likely it is that a free user is recommending the product to another user which itself has a chance of becoming a paid one.

Time of self-qualification: While the time necessary to arrive at a later stage becomes longer there’s an obvious upside to letting users go at their own pace. Users can qualify themselves through the process up to a point where they reach out to us and have already experienced a lot of value themselves.

This shifts the conversation by sales from generic inbound leads to highly interested inbound leads that are much more informed about your product’s value proposition and whether it offers a good problem fit.

The overall time to close goes up but the time from sales interaction (if it happens at all) to close reduces.Willingness to pay: Engaged users have a much higher willingness to pay than non-activated users. This might be counterintuitive to classical sales-led companies as they like to get a hold of the prospect as soon as possible.

Knowing this, we now should have a rough idea of how much a potential future solution could offer for “free” before a customer needs to interact with sales. Or they might even close completely by themselves. Closing accounts by themselves up to 10’000 USD per year is not uncommon anymore at all.

4.1.1 Virality and Word of Mouth

While I visualized the above flow as a funnel I highly recommend looking at your users as a self-running loop. It’s commonly referred to as a flywheel or growth loop. Every user that lands on your product has a chance of attracting others.

Fundamentally this is what product-led growth is about. Users acquire other users. The more downmarket you go the stronger the effect is and cannot be ignored.

If you don’t do it, your competition will. You cannot compete with a distribution model that costs 0$ per user.

4.2 Analyzing your current product (optional)

When we look at the start of our Inventory it’s optional to include your product into it. There’s an inherent danger to focusing too much on your solution. Your customers use your product but ultimately their problems live outside of it.

Addressing, and understanding the problems first without focusing too much on your product can help and simplify finding good opportunities.

As long as you are aware of that you can still do a full teardown of your existing product by splitting it up into growth and acquisition:

I would limit it to 3 core steps first thing: Acquisition, activation, and retention.

They fit into our customer lifecycle as follows:

Acquisition → Activation → Retention → Referral → Revenue

Same for “Referral” as the next step until you have nailed the other 3 steps successfully.

While product-led growth is incredibly strong when it comes to virality and network effects (referral) you cannot skip any steps to get there. Only retaining products will be referred and only activated users can retain them.

The following steps can be tested by observing test users or simply doing this as a team exercise to start off.

Detach yourself for the moment from thinking in Accounts. When I talk about “Users” I really mean "people who are using your product”, we deal with “Buyers” and Accounts later.

4.2.1. Acquisition

“How are users discovering our product”

It makes sense to really walk through the process of a typical user in today’s flow with your product and map it out:

Do we offer a free version of our product that users can explore to form a mental model of what the product is about?

This includes also the cost side, if pricing is not clear a product might disqualify itself quick

If not, what kind of material do we offer that comes close to a free version?

If not, what kind of interaction do our users have to take to get to that step?

Interacting with a form

Booking a sales call and so forth.

4.2.2 Activation

“How are users reaching success with our product?

Once a user is aware of our product how do they reach success in it (Aha-Moment, see 2.3 customer success)? (This can be after having received access by sales or through a self-serve)

Is the product self-explanatory to reach a value output?

If not, is it a problem to find the provided information

Or because the product needs to be explained by a salesperson due to complexity

If not, can success only be reached by integrating data by the users themselves?

4.2.3 Retention

“How are activated users continuing to engage with our product”

Once a user (people using it, not the buyers) has experienced success with our product what drives them to reuse the product?

The product is so easy to use and the value that they want to use it

If not, is your product easy to onboard but not easy to use repeatedly? (Single vs. repeat usage)

If not, are they using it because they are told to use it?

4.2.4 The (imaginary) product-led growth version of your product

Once these 3 steps have been mapped out you have some first indicators of how a product-led growth version of your product could look like by specifically targeting the gaps (which can be changed) from Acquisition / Activation / Retention we surfaced.

In general, it makes sense to try to design this flow with as little human interaction necessary as possible:

Acquisition: Free, self-serve version of our product

Activation: Easy to use and fast way to get to a first-value version of our product

Retention: Balancing easy-to-learn and easy-to-use repeatedly. What does our product look like if we focus on the most used actions?

By the end of this exercise, you should know how far you are actually away from having a product-led growth version of your product. The 3 areas around acquisition, activation, and retention are all focused on product work and give you a rough idea of what’s necessary to change.

4.2.5 Monetization

When to pay is a crucial component in any product-led growth flow as we explored in 4.1. We generally want to move the payment step as far back as possible.

While an initial implementation for a self-serve monetization might be given to the “product” teams to implement you will notice that there is natural tension emerging between sales and product because of it:

“You’re undercutting our pricing, our offering is getting too complicated.“ ← Your average SDR seeing PLG come up in an organization.

The answer is contained in the next steps

5. Redefine: The definition of “Product”

Terminology is important to nail from this point forward.

When we talk about “Product” we don’t mean people working in that function. We talk about the value of our customer’s experience beyond the “core product” (what you are selling):

This simple extension of the term can turn negative things like your platform going down into a retention driver.

Specifically when we talk about the post-product experience, anything on top of your core value... support should never be an afterthought and should be incentivized accordingly.

We reduced at Smallpdf our support response time to 15 minutes. We knew how directly this experience was correlated to their retention behavior (and reducing churn).

Also, your support and how to get ahead once you get stuck can turn something negative into one of the strongest retention drivers:

"We had a service outage of two hours in the night. Hopefully, none of our customers noticed it"

Should turn into

"We had a service outage of two hours, let's proactively inform the customer in any case as fast as possible."

One of the most placative sentences that you could stick on your door is

-> "We know that something is wrong before the customer does." <-

If you are proactive about failures you generate trust. For that, you need to be able to monitor, surface, and act on it. That's why it's part of the product. *Especially* with big contracts.

Let’s use this definition when we continue talking about “Product”.

In simple terms:

Sales & Marketing are not just selling the core product but extended value coming in from pre and post-product experiences if we can prove that they matter to the customers and which ones (ICP) at higher efficiency.

Sales results: Higher close rates

Marketing results: More revenue (LTV & ACV) per MQL for the same spend

6. Focus: Find 3 ICPs and their 4 success signals

Sitting down with your team and understanding the different stages of your user’s success is crucial. Before we do that we should look at for whom we are doing that. This is very similar to a positioning statement for a product but now for individual groups.

6.1. ICPs

I’m a strong proponent of understanding product-market fit as a function of your customer groups, aka your ideal customer profiles and not your overall product. This impact of segmentation gives you a completely different view on your product:

This might mean that you have different product-market fit answers if someone asks you whether you have product-market fit.

An ICP (Ideal Customer Profile) is a profile of users that are the best fit for your product. They retain and pay the best. You want as many of them as possible. They are the primary users we develop the product for in a product-led business.

Unfortunately, they sometimes get lost in the noise if you spray and pray with your acquisition methods as is very common for many startups. Especially in those cases, PMF is understood best as a metric that you have to find for a group rather than your entire user base.

Your retention might look something like this:

Retention for all of your users after 8 weeks: 5%

Retention for ICP 1 subgroup after 8 weeks: 20%

Retention for ICP 2 subgroup after 8 Weeks: 3%

Depending on how you defined your ICP you just uncovered that your product is an awful fit for the 2nd group but a much better fit for the first group.

This gives you now the opportunity to focus on ICP 1 (and scale only that) or evaluate what went wrong with ICP 2 and improve on them.

Further reading: B2B ICP profiles in SaaS by breyta.io

6.2. Good and Bad ICPs

You want to keep this exercise simple so you can communicate it effectively in your company.

Good ICPs

Great ICPs make up at least 15% of your potential customer base for any product portfolio and profile.

Keep it to three profiles. Ensure that at the very least you consider focusing on ~50% of your user base if you would combine all your ICPs, that way you are addressing enough of your users while ignoring enough of adjacent users that are not your perfect audience.

Include Firmographics like company size, industry, geographic location or special technologies they use.

Validate your ICP: If you create an ICP that’s dominant in your existing user base look for signals in your data (customer surveys, quantitative data, sales feedback) to validate it.

Bad ICPs

Being Too Broad or Vague: If your ICP could apply to nearly any company, it's not going to be very helpful. Be as specific as possible.

Ignoring Feedback: Sales teams, customer success, and even your customers themselves can provide valuable feedback on your ICP. Don't ignore it.

Failing to Update Your ICP: As you learn more about your customers and as your business evolves, your ICP will evolve as well. Review and update it regularly.

Overlooking Customer's Challenges and Goals: The ICP should not only include your business's view but also account for your customers' perspectives of a problem their dealing with.

We create good ICPs for all company functions, that includes marketing, product, and sales. Just because we’re going it in the context of product-led growth doesn’t mean it’s just for people with the word “product” in their jobtitle.

6.3 Customer Success Signals

Keeping this simple and limited to 4 steps is a common way, I like doing this exercise per ICP:

Setup / Aha! / Eureka and Habit Moment:

Setup Moment: These users are ready to go and interact. What does it take to reach this moment?

Aha Moment (Similar to Activation): The moment a user modifies and downloads a file. → They’ve realized the value of the product.

Eureka Moment: Not only did they realize core product value, but also additional in-built values like “collaboration”. This is an important signal that they are high-value buyers or ready for expansion.

Habit Moment (Similar to Retention): These users are likely to stick with you for a long time or become buyers

Be very specific and define for each point whether you can measure a signal to determine: “Yes, they have reached this particular stage”.

For instance, a Setup Moment is usually reached once a user has downloaded a mobile app, or logged in to their account if that’s what your product requires.

6.3.1 On the example of Smallpdf’s ICPs

If we would apply this frame of mind to Smallpdfs complex ICP group which is living more upmarket:

Setup Moment: The moment when a user uploads a file. → They are ready to go and interact.

Aha Moment: The moment a user modifies and downloads a file. → They’ve realized the value of the product.

Eureka Moment: A user invites other users to edit the file with them. → Not only did they realize core product value, but also additional in-built values like “collaboration”. This is an important signal that they are buyers.

Habit Moment: A user processes more than 3 documents/day over 30 days. → These guys are likelier to stick with you and become buyers!

6.3.2 “But we cannot measure this…”

Typically doing this exercise surfaces the problem:

“But we cannot measure this…”

The next decision needs to be made. Do we invest in product data analytics or not?

6.4 Is product-led growth for us?

Before we do that it makes sense to pause and know whether we should go for it:

Competitors: Are there already existing incumbents offering the same value proposition that we have as a self-serve product?

A practical example from advising: https://seon.io/

This is an exceptional example I discovered when advising a sales-led fraud prevention service, which drove home that it is indeed possible to have a self-serve product for their audience

Surmountable Gaps: Do we see a version of our product that can be self-explained and good for showing value by itself even if we don’t have it yet?

Ignoring CAC questions, does it make sense for lower market segment accounts <10k ACV to use our product or a version of it?

If we see enough chance for either one of those 3 to happen then it’s worth it to go forward

7. Measure

7.1 Data and Visibility

This is the first thing that might infer cost if you don’t do it yet. Whether and how to measure data about your users.

I highly recommend resisting the urge to ship any self-serve version of your product without minimal tracking of user actions:

It’s unlikely that leads magically start to come in on your first try

Product-led growth impact on revenue takes more time than you might think

Learning from failed experiments is a quality of product-led companies it takes skill to do so

If you kept it simple and you have 4 hypothetical success signals you can start thinking about how to measure them.

Measuring data is the easiest step after solving the technical implementation, the question is then how to interpret it correctly and leverage it.

If we agree that understanding the user is always beneficial for any business then we can temporarily shelf the question of how to leverage it.

While it’s difficult to define what a “good” or “bad” Setup / Aha / Eureka moment is based on flat performance numbers visualizing it can help a lot. A good principle to live by is that these are consecutive steps. Only those that reach a “Setup” moment can potentially reach an Aha moment and so forth.

If possible we can already segment this data per ICP

If multiple things are broken start at the beginning and then take it from there. The first step is to create “some” visibility.

For recommended tools and resources, see 13. Tooling & Ressources

7.2 Split revenue reporting

Separating (internally) and tracking revenue attribution is a great way once you do see traction to visualize the growth of your self-serve motion. Important to note there is that it’s not only important to attribute whether revenue came from self-serve originally but also whether it expanded over time.

For company buy-in, we need to make sure that classic market understanding which builds on these public P&L sheets is not getting in the way of us bringing PLG into any revenue function of the company.

This is specifically a problem if you don’t really understand how SaaS businesses operate. In order to understand a SaaS business you have to under Annual Recurring Revenue. Public statements about companies traditionally only show Revenue. You cannot infer ARR from Revenue and therefore cannot

The latter is something that materializes a bit later in the lifecycle of a customer but is definitely worth it to visualize it. We need to be able to track and report these functions.

Specifically in Sales-led organizations, we might have to make some changes to how revenue is attributed to understanding what’s coming from where:

In either case, the goal of this exercise is not to be the most precise. It’s actually quite common at some point that your customers bounce between silos, they might start with sales and end up self-closing.

What we want is to have some idea of whether we have a useful expansion and to generate buy-in for the idea. We can only evaluate the health of our self-serve motion if we look at recurring revenue numbers.

8. Implement: Goals & Org changes

We need to have people identify and deliver on what we want to achieve. Those are our product and growth teams. Our Goals are the most powerful tool in our toolbox to maximize our chances to go in the right direction with them.

Let’s see how we build both of them in an ideal environment

8.1 Growth & Teams

If we understand at this point that customer success can happen in more than the core product but also in the post and pre-product experience it makes sense to give teams more autonomy to influence these metrics.

Product teams have traditionally no influence over acquisition and Marketing traditionally struggles to change anything in the core product.

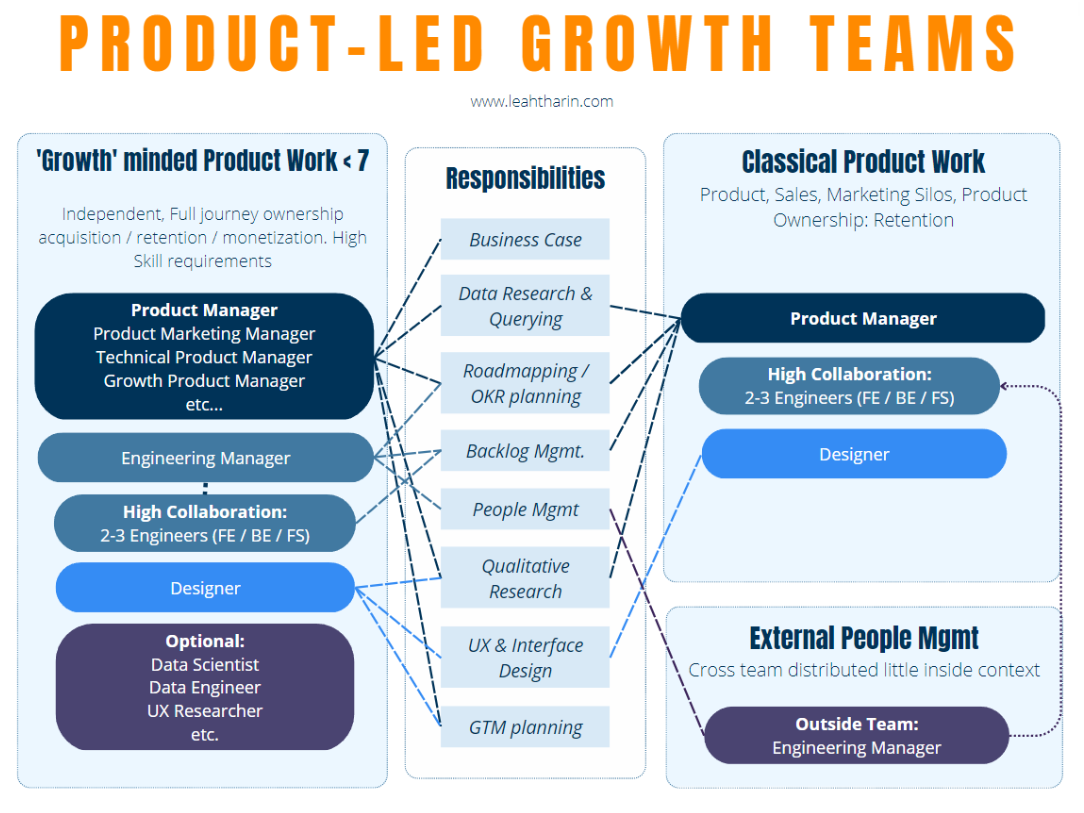

Growth teams are structured around ICPs and their entire journey or even individual customer success signals. I see them attached organizationally more often than not under Product and not Marketing due to their similar structure.

The purpose of a growth team is to be an autonomous, impact-guided unit in our organization to deliver value aligned with customer success. The ideal size is 4-7 people. Any higher, and the increasing communication lines risk misalignment and friction.

This might mean that one growth team has a product marketing manager to deal with increased acquisition overlap problems whereas another team has a “regular” product manager but an insourced data engineer.

Growth teams are for this reason more individually staffed. We identify the problem first and then put the teams together, not the other way around.

We follow the philosophy:

Wherever possible, we eliminate dependencies - not manage them

There is one important thing to be mentioned when it comes to business casing. Because of the diverse area of growth teams, I require my product managers, in general, to be excellent at creating business cases.

Finding opportunities within customer success signals is usually a very collaborative exercise in a team and struggles in directive organizations.

Directive idea management does not scale. Even if you were the smartest person on the planet, you can’t feed more than a couple of teams with ideas. And even if you could you’re probably overestimating your abilities.

This means the team needs to come up with their own suggestions on how to move the needle. This requires interviewing, evaluating, and knowing your customer’s problems better than anyone else in the company.

For more detailed insights

8.1.1 Roles of (growth) product managers

Reports to: Product → Growth

Business and customer expert within the team. Responsible for facilitating ideation, prioritization, and delivery.

Accountable for business value, but also that the team believes in that value. Gives purpose to the team.

Develops deep expertise in the product area.

Creates empathy within the team for the customer and the problems being addressed.

Drives high alignment: shared vision, mission, values, identity, shared context & transparency, drive business value (KPIs), real-time info

Accountable for product backlog & product vision

Facilitates backlog prioritization with input from customers & team.

Focuses on the “what”, and collaborates with Tech Lead / Engineering Manager who focuses on “how”.

Defines what “done” means, accountable for the quality

Works with other teams

Variations:

Technical Product Manager: A more technical profile that creates APIs / SDK, etc.

Product Marketing Manager: The more marketing-driven profile, coordinates with Marketing to ensure that features are delivered into the market properly

8.1.2. Roles of engineering managers

Reports to: Engineering

Engineering manager and technical lead for the team. Responsible for ensuring we sustainably develop software.

Manager of engineers within the team.

People accountability: hiring, firing, performance evaluation, onboarding, coaching, retention. Creates a sports team mentality.

Delivery accountability: focuses on “how”, scrum master, manages sprint, guides toward sustained high velocity, continuous improvement, removes roadblocks, timely delivery

Accountable for technology health but delegates ownership to other team members.

Communicates with other engineering stakeholders. Responsible for negotiating dependencies and resolving blockers.

Time to contribute as an IC Software Developer (only possible in small teams)

8.2 Goals

8.2.1 Value capture vs. creation

Value capture metrics like revenue and churn live in the management layer and should not be directly influenced by teams through goals.

They are important in terms of evaluating business performance and as a tool for finance but are ultimately a result of customer success.

If management doesn’t believe in the correlation between customer success and value capture we have a fundamental problem:

Capture metrics are fundamentally incredibly hard to move for individual teams. Metrics that are hard to distinguish from natural fluctuation are demotivating and based on luck.

They incentivize bad behavior and short-termism, we can move revenue by making it harder for customers to unsubscribe or get access to support. This might boost short-term revenue but ultimately kills your long-term value.

See: https://www.mckinsey.com/mgi/overview/in-the-news/the-case-against-corporate-short-termism

https://hbr.org/2015/10/yes-short-termism-really-is-a-problem

Customer success leads to long-term business value

High customer engagement (frequency of product usage) leads to high retention, which is an indicator of customer success. Which, in the end, generates revenue.

Early warning signals make great team goals.

A drop in customer engagement is the first warning signal that your retention will drop and that customers will ultimately leave your product. It indicates things could get ugly.

Engagement is a leading indicator of user retention which is a leading indicator for a drop in revenue.

See: PWC Study, Bain&Company study

That’s why defining team goals around engagement and retention metrics is a great way to success that matters not only on paper.

8.2.2 Outcome-driven success goal setting for teams

Every sales leader can tell you that a good incentivization structure in their teams is the foundation of any success.

That’s why outcome-driven goal setting is important for any organization that wants to nail product-led growth:

“Our team delivers feature x by (date)” is an output-driven goal.

Output goals are fundamentally flawed because they have no quality attached to them. A team can be successful by delivering something that does not affect the business whatsoever, they don’t have to care about the customer.

“Our team improves the number of documents our users share per user by (date)” is an outcome-driven goal.

An outcome-driven goal is ideally measurable and correlates to the revenue but not directly. We use value-creation metrics as team outcome targets (see next section). This makes them harder to manipulate

By measuring team performances on their outcomes we give them the freedom to do whatever they think is best to influence their goals.

They might figure out that a hypothesis does not deliver the results they hoped which allows them to pivot to other methods which influence the same quality metric (for instance customer happiness).

Since we know at this point about potential ICPs and their customer success signals we can go one step further:

“Our team improves (customer success signal) for (ICP) by xxx in by (date)

While it’s unrealistic in any planning to always only target ICP success metrics they offer a very nice option wherever possible for teams.

8.2.3 Processes

I’m a big fan of unshipping processes and rituals and if you’ve done the above successfully you can start getting rid of unnecessary traditions.

Burnup charts where we estimate team performance solely on “how many points” they got done can be completely done away with for instance. We care about the customer success signals and that’s all that matters.

There is one thing though that I argue is non-negotiable: Weekly customer interviews per team

I’m not very specific about whom you talk to as long as they are closely enough related to your ICPs:

Market Research

UX Testing

General pulse feeling

Whatever it is. We don’t know what we don’t know and it always starts with the customer or potential customer.

The closer your teams and you are to the customer the more long-term value can form. You cannot guess customer success, you have to see and measure it.

See 10.3 “Product-led OKRs” in 10. Common Pitfalls for a detailed frame on how to structure OKRs that bring it together.

9. Product-Led Sales

We now have created the conditions to bring it all together to deal with product-led sales. We have team structures that can influence what matters in the product and connect it with what matters for sales.

We measure outcomes that matter to the customer and with that, the implementation of product-led sales becomes much easier. Product-led sales pull together what a pure product-led or pure sales-led approach struggles with:

9.1. Deal Qualification

In order to operationalize what we know about our customers and users we can attach different signals to them that inform us whether we should reach out to them. The idea is simple:

If an Account/Lead meets specific criteria they are ready to be closed

Leads who have not reached this criterion are not touched

9.2. Product-Qualified Accounts

What we are essentially trying to do is to give a better tool than what our traditional Sales crew has: Sales Qualified Leads (SQL)

For that, we need to shift our understanding of customers and users slightly. Not every user is a lead and we can group them together per Account:

A potential enterprise customer in our pipeline consists of multiple users and within those we have teams. These accounts overall have a specific behavior and we look at them as conditions to be ticked off:

Uses product successfully (Habit). A common example I use is Slack’s 2000 Messages within 30 days metric. If an account goes above this threshold (which you need to define individually for your product) they check this box

Point of interest reached. If you have specific pages or actions only a very interested account would perform then you can define them also as signals. A great example often mentioned by Elena Verna would be Terms of Service pages. I often also look for things like SLAs or ultra-niche specific case studies/features that are hard to find unless you look for them with intent.

Account virality: As soon as users/admins are starting to invite more users (and those who are using the product) you have a great signal that your account is starting to be really successful. It can be tied to how many new users are now in the account or simply by how many things are being processed. For a document platform like Smallpdf that would be the number of documents or users collaborating around one document.

A great episode on how first PQAs could look like is a conversation I had with Tim Geisenheimer of Correlated, their tooling does just that:

Once we have potential trigger conditions defined we can attach points to them as you would with traditional MQL / SQL scoring systems. Keeping it simple on a scale of 1-10 works best here as well. All you then need afterward is a threshold where you define the Account to be qualified. I.e. anyone above 5 points is considered Qualified or Product Qualified.

9.3. Product-Qualified Leads

Product-qualified Leads are the final piece of the puzzle to let the Sales hounds loose. They are a subpart of any Product Qualified Account

I often get asked how we differentiate between buyer and user personas in Product-led Sales.

Product-qualified Leads are the closest thing you have to a buying persona. They are the ones that can pull the trigger and are the person you want to get on the phone.

If we can identify them and know that they also are users of your product then the magic is happening. It’s time to close.

PQLs are often bouncing between product and sales since they need to make the informed decision and this differentiates them from "normal” users within an Account.

This gives you an excellent opportunity to leverage sales, customer success, or any support function that might come in touch with an Account:

Their feedback is crucial to figure out which one of the users is the or one of the PQLs.

They use the product: Reach out through sales

They don’t or only sparsely use the product: Marketing and other targeted outreach prospecting.

9.4. Expansion Qualified Accounts (EQA)

Whether you call them expansion-qualified leads or stay with the initial definition doesn’t matter. We can apply the same principle to Accounts that are using and paying for our services to see whether they are ready to expand:

EQAs are ready to increase revenue and are already our customers.

They are different in another key aspect, we know already who the buyer is in them since we have a running relationship with them.

We use the same framework that we use for PQAs to determine whether they meet a specific threshold to be ready to expand:

Hitting specific paywalls or limitations on the regular of extended value we have

We can structure our product in this way but be careful to not turn this into a frustration exercise. Individual enterprise users expect to be able to use everything. But we can definitely hint and make it easy for admins/PQLs to see the extended value.

For them, extended value is something that could help them to be even more successful in the company they are as they are most likely not the primary users but use this value to drive business success through their teams.

If you spin this further and are in a bigger organization you can form expansion revenue teams around this, but don’t forget to reward sales:

9.5. Sales Ramp up and Incentivization

When starting off with Product-led Sales qualification we need to be careful about how it’s done. If you qualify your accounts (and leads) too fast you are not leveraging what’s important, customer success signals.

Throwing the entire pipeline in your current Sales pipeline is a recipe for disaster. That’s why you should separate it from your traditional sales pipeline at the beginning.

Starting with just one customer-centric sales resource that understands your goal here is a great approach.

They can give you clear feedback on whether the qualification is working and how to improve it. You might also have a conversation with them on incentivization. If sales are incentivized on closing high initially they might destroy the delicate strong buyer signal you already have.

We try to close in a size that is best for the Account so they can expand later. We don’t sacrifice long-term revenue for short-term bursts that look nice on a balance sheet.

In practice, this means we’re not overselling seats or features these accounts don’t need. You should know based on usage data what is of interest to them. Keep it simple, keep it small. They will give you more signals to expand.

Before we scale our one person into a team or to a wider sales organization we need to make sure that the PLS pipeline stays bigger than the amount of salespeople you put on it. (See common pitfalls later)

9.5.1 Sales Incentivization

When I say we shouldn’t reward Sales too much with a high closing bonus to not burden the customer too much then we need to give them an alternative.

Not adhering to this principle means risking account churn or them simply downgrading.

Unfortunately, there is no simple global formula except to somehow play with payout timing and customer success. Just make sure that it’s crystal clear to a salesperson that in their average tenure, an onboarded account like this makes them more money than the classical simple signing bonus.

Good targets for that are upsell, cross-sells, and account renewals.

Even if sales hands off accounts to your CSM teams we have to make sure that they get a piece of the pie.

9.6 Product-led Sales example - Sunrise

Sunrise is a major Swiss mobile phone and infrastructure subscription seller and they are present in all market segments.

We were presented in 2018 with an over-commoditized market and a strong push from more and more enterprise clients to self-serve their products.

We were heavily prohibited from simplifying this process though due to the complicated deal structures and internal processes. It was simply not possible to explain in simple terms how all the deal and rebate structures were supposed to work without an actual SDR doing so over the phone.

We did see an opportunity to self-serve products though because more and more of our clients started to simplify themselves. Instead of fixed telephones, people were using their own mobile subscriptions or just needed additional sim cars without anything else.

We had the data just lying around:

We knew even though numbers were distributed whether they belonged to the same accounts due to them being on the same accounting invoices. Most enterprise accounts were compensating their salespeople for cost and we could use that to pull them together. PQAs were born.

Analyzing these accounts gave us important usage metrics and allowed for targeted sales outreach as we already also had the relevant PQLs defined.

For completely new accounts though we simplified bonus and rebate structures towards the customer and let them shop with a system they knew from classical e-commerce businesses. Put your stuff into a cart and see what it costs and delivery dates before you buy.

This process was extremely stitched together and was not connected to any back-end process in any way. If a customer tried to self-serve we sent an email with all the details to an SDR that immediately (within minutes) reached out. They had all the necessary information at hand, including connected usage metrics if present.

The goal was to close low and carefully and not introduce more friction. These accounts had a much higher expansion rate than those that rolled through our traditional sales pipeline. But we had to adjust sales incentivizes and a lot of processes internally to have even a prototype pipeline going.

That new pipeline though performed very well in regards to upsell and expansion because those accounts remembered how they were onboarded.

I drove this process back then out of the SMB division which seemed simpler rather than going over Sunrise’s enterprise division, which to this day is extremely old-fashioned.

They sure are glad though to receive more enterprise accounts from the puny SMB segment at times now.

9.7 More Product-led Sales Resources

I’m working on an extensive public PLS Guide but in the meantime please consider Elena Verna 's resource on PQA and PQLs: https://www.endgame.io/blog/elena-verna-pqa-pql-guide

And her blog Elena's Growth Scoop for the only other perspective I trust when it comes to PLS.

9.8 What’s left?

Learn in the following sections about the most common pitfalls when we talk about integrating PLG / PLS for sales-led companies, tools, and a detailed OKR framework to drive it all. Further resources to round it all up.

If PLS is done right you also now have unexpected allies:

Using a downmarket segment to build for an upper market

Unexpected expansion revenue

Payback Periods as health metrics for PLG

Let’s have a look at it all in detail…

10. Common pitfalls

10.1 Treating collaborative environments as “Optional”

I strongly advocate for an outcome facilitator-based model. The model is structured around 2 core principles:

Outcome-driven over output: "We aim for a specific if possible measurable impact for the customer over just shipping features” → Business outcome

Collaborative over directive: “The team decides as a unit on what makes sense to build to further the company strategy.” → Facilitating the team

The reason why I advocate for this model is that it tends to be the best fit for growing companies that focus on customer success. It’s a bit tricky to set up but scales very well for very common business models like SaaS.

A feature owner model, for instance, is common for very early startups:

The Founder has a clear, strong vision and is hiring lots of contractors to execute this vision early to find product-market fit. It’s directive and noncollaborative in nature.

It’s very easy to set up. You can just divide the few teams you have in areas of your product.

But the feature owner model doesn’t scale well due to the operational disconnect from the founder to the operational layer:

As you add more people to the organization your teams tend to become experts in sub-segments and the founder needs to step into a role that guides the general direction without micro-managing teams.

Without goals and a quality-oriented mindset, teams risk delivering unguided features without impact. That’s why shifting to an outcome facilitator model should help.

Read More on this: Organizational Structure types by Reforge.com

10.2 Ignore data and replace it with “sense”

A very common one is to skip proper data tracking and just go with gut feeling. There is a big body of research proving that we are incredibly bad at predicting what the future holds.

Especially if we think we are individually an exception. Experts that think of themselves as experts with strong opinions are the most imprecise.

This is especially relevant in a complex system like product development. We predict all the time what we develop will have an effect. And we are comically often wrong about it.

Sales-led companies are especially prone to this because there is often nothing else to go on than opinions. We need to unlearn this false sense of security when we have better data available:

10.2.1 Cognitive Biases and Limitations

At the heart of this conundrum lie cognitive biases and limitations that influence our thought processes. Confirmation bias, overconfidence bias, and the anchoring effect are just a few examples of how our minds can lead us wrong. These biases can distort our perceptions, cloud our judgment, and contribute to our overestimation of forecasting abilities.

10.2.2 The butterfly effect

Complex systems (like product management or human needs) are often subject to the butterfly effect, where small changes in initial conditions can lead to drastically different outcomes. This inherent unpredictability can render accurate forecasting an almost insurmountable challenge.

This especially applies to qualitative sources of data like hypothetical questions to our users. “What would you do in the future if…” “What would you need to buy this contract right now”

Our users are inherently bad at predicting their own future actions, and we are not well suited to analyze it either. Focus on the past.

10.2.3 IARPA and the Good Judgment Project: Tackling the forecasting problem

Recognizing the limitations in forecasting abilities, IARPA (Intelligence Advanced Research Projects Activity) launched the Good Judgment Project, an ambitious attempt to improve predictions in geopolitics and other complex domains. This groundbreaking research initiative sought to explore methods for mitigating biases and leveraging human intuition to enhance forecasting accuracy.

10.2.3.1 Crowdsourcing forecasts

The Good Judgment Project employed a crowdsourcing approach, assembling thousands of "super forecasters" with diverse backgrounds, expertise, and perspectives. These individuals were tasked with making predictions on various geopolitical and economic events, and their forecasts were pooled and aggregated to generate more accurate, collective forecasts.

10.2.3.2 Lessons Learned and the path forward

The Good Judgment Project has demonstrated that it is possible to improve our forecasting abilities in complex systems, albeit with limitations.

Key takeaways from the initiative include:

Humility and continuous learning:

Overconfidence is a significant barrier to accurate forecasting. Embracing humility and adopting a continuous learning mindset can help mitigate this bias, leading to better predictions and more informed decision-making.

Do not assume that you know what your customers want from observations only. Try to form a hypothesis that can be verified. Product-led Growth works especially well in this case because you often CAN do that for the first time: you have enough users to verify.Leverage diverse perspectives

Incorporating diverse perspectives and expertise is crucial for overcoming cognitive blind spots and improving forecast accuracy. The power of the collective can often outperform individual efforts in tackling complex problems.

Within teams cross-collaboration is important, a directive style of management is not effective. Cross team, we should involve the opinions of all silos. Including Marketing, Sales, and Product. This is not a product initiative.Prioritize probabilistic thinking

Thinking in probabilities rather than absolutes enhances our understanding of uncertainty and improve forecasting abilities.

We assume too fast that we are aligned “This is valuable for our customers” “We all understand what a ‘success’ is”. Trust but verify alignment.

10.3 Not doing Product-led OKRs

The road to product hell is paved with good intentions. A big one is to not have a tight grip on how to structure OKRs or short-term goal tracking:

10.3.1 OKR Structure Example

I structure my OKRs in the following way and implement something similar or all my consulting clients:

(See description of every Meeting right after)

3 months, split in 6 x 2-week sprints

3 OKR check-ins (1 / month): There are extremely important to adjust and stay flexible. The smaller your company and the more your market moves the more likely it is that you need to adjust during an OKR

1 OKR Celebration (1 / Quarter): Celebrate your team’s successes and get them together. It’s a powerful exercise for morale but also to visualize and show what we moved. It’s easy to forget.

We celebrate moved customer success, if you celebrate feature launches without customer impact you reverted to not being product-led

1 Sprint before the OKR ends teams are already planning for the upcoming OKRs, this burden falls mainly on product management and engineering managers to organize. We want to understand our current learnings and use them to inform the next 3 months. This happens naturally as the team prepares a look back for the celebration meeting anyways.

10.3.1 Goal Setting

My process following having a good overall strategy is as follows for each team to find their OKR commitments:

Idea Gathering: Brainstorm individually

Identify and Verify: Identify Ideas that are worth it and discuss together how you could verify their success (customer success signals), define draft Outcome based Key Results without numbers attached. (i.e. “Increase the number of self-benchmarked prospects)

Stackrank: In which order would we execute them if we had to decide?

Write up: Attach a written hypothesis to them and check with every team member whether everyone still agrees with the stack rank.

Scope / Capacity: Based on the above, what can we fit into an OKR cycle (commonly 3 months)? Draw a line to cut off.

Scale of KRs: Put actual numbers behind your outcomes defined in step 2.

10.4. Scaling product-led sales resources too fast

I initially pointed out that it’s important to attack a market segment that offers enough leads. Once the first leads are starting to come in it’s tempting to hire more sales resources or reallocate them to deal with it.

The point of product-led sales and product-led growth is to qualify your leads heavily first. If you don’t do that well you will end up soon with too many sales resources handling too many leads.

The effect is that they won’t wait for a clear customer success signal and start to grab leads prematurely.

It’s inefficient and ultimately unsatisfying for sales as well. They might close at the same rate as before but for a far lower value. That’s demotivating you and leads you to the erroneous conclusion that your PLG experiment failed.

10.5. Implementing PLG/PLS while not dealing with sales incentivization proper

We already established that anything product-led growth is a company initiative and not just for “product”. A great example of this is sales incentivization. If we leave sales operating PLS leads the same way they deal with their normal accounts then they don’t want to handle them or will do so just as a side deal.

We need to incentivize customer success somehow to find really good revenue, and that’s only possible if we measure it. We can only measure it if we also defined it and have a common understanding in the company of it.

If Sales is grabbing deals prematurely because they started to run out of deals you’re killing your entire Product-led Sales pipeline and end up with a mess of “PLS doesn’t work for us”

11. Unexpected Allies

11.1 Using a downmarket segment to build for your upper market selling

You can learn quite a lot from expanding your customer base downmarket.

We now can experiment in areas that are applicable for both segments (mid and enterprise). UX is a great example, a good interface is valid for both.

We need to make sure though that enterprise products (a product for teams of teams) still might have some different views and flows than a midmarket tool.

The individual features though are more often than not though the same.

This is a welcome ally for product development because you have to rely less and less on fuzzy concepts like “product sense” and can optimize your products with data.

11.2 Unexpected expansion revenue and payback

Initially, you might treat self-serve revenue and acquired enterprise revenue as two separate streams because they come from different markets.

Since we start to grab accounts earlier in their maturity cycle they also have a chance of slowly expanding over the years. Over time a portion of these accounts will mature with you and if your monetization is set up correctly (usually by way of tieing pricing to usage or seats) they gladly expand.

The entire business model for that can be found for instance with Hubspot (22$Bio Market Cap as of Q2 2023). While they acquire most companies in the midmarket segment some of them expand naturally into being proper enterprise accounts.

They don’t stop there and started a couple of years ago to go even more downmarket to early-phase startups:

https://www.hubspot.com/startups

If you would look at the flat CAC to LTV ratios that would make little sense in a classical ROI breakdown. If you factor in that some of these accounts naturally mature into mid-market and enterprise then the case makes sense.

Expansion revenue makes only sense though if you trust your product to be exceptional and scaleable. Noone renews subaverage experiences when there are other alternatives out there.

Especially as accounts become bigger they tend to pay more attention to unit economics. A newly hired CFO will start to look closely at how much they pay per employee for licensing costs.

Make sure that view looks good enough. If you oversold an account they will spot that.

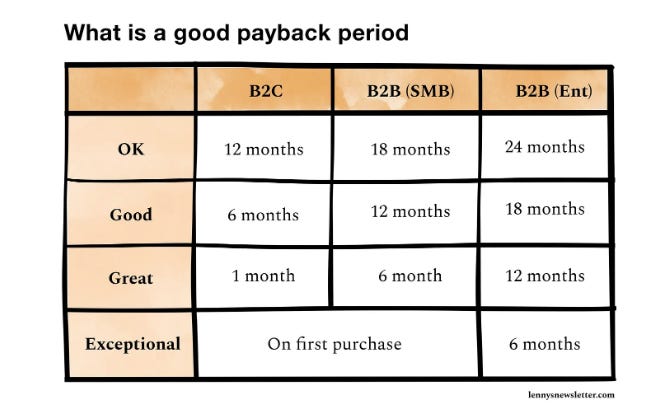

11.3 Payback periods and CAC

This is an important health metric to consider. If handled right it becomes a strong ally. Payback periods make sure that you’re on the right path with the right velocity. Elena Verna has a fantastic article on this topic

12. Tooling and other Resources

12.1 Blogs / Newsletters

I write obviously a lot on this topic and if I’m available I’m always open to listen to opportunities to work together.

Elena is my number one choice when it comes to understanding cross-functional connections. She connects the dots between Product, Marketing, and Sales naturally while focusing on customer success at all costs.

Her structured thoughts make it easy for scaling B2B businesses to translate her advice into business traction.

In Ben’s words: “Helping founders of B2B SaaS startups serving developers and other technical audiences win with PLG.” His extensive background offers lots of great frameworks and expert knowledge. Highly recommended.

Adam is absolutely fantastic when it comes to organizational changes related to anything growth. Growth Leaders, hiring - whatever it is. He’s my go-to source and has a running cohort on Reforge with Elena Verna teaches just that.

Their growth leadership program

The Stage 2 Capital Blog is run by a VC fund focussing on Scaleups predominantly doing PLG. Great resource across the board.

12.2 Analytics tools

Great analytics tools that I have used in my career and would vouch for when it comes to analyzing customer signals:

Mixpanel: Mixpanel is a product analytics platform that lets companies analyze how and why users engage, convert, and retain in real-time across devices. Its unique feature is its user-centric tracking that allows businesses to track customer interactions across different platforms.

Amplitude: Amplitude is another product analytics platform designed to help businesses track users' behavior with a focus on user engagement and product optimization. What sets Amplitude apart is its advanced behavioral analytics capabilities that allow for deep user journey analysis and segmentation.

Loops: Integrating on top of Mixpanel and Amplitude, Loops specializes in showing growth opportunities. It requires at ~600 users to generate relevant insights from your user base for instance with Product-led Sales.

Looker: Looker is a business intelligence software and big data analytics platform that helps you explore, analyze, and share real-time business analytics easily. Its uniqueness comes from its modeling language, LookML, which allows for data exploration in an intuitive, code-based environment.

Growthbook: Growthbook is an experimentation platform designed to facilitate A/B testing and data-driven decision-making. It's unique in its focus on experimentation and user experience optimization, allowing for robust and customizable test design and analysis.

Metabase: Metabase is an open-source business intelligence tool that allows anyone to ask questions and learn from data. Its unique selling point is its simplicity and user-friendly interface, making it possible for even non-technical users to generate reports and visualize data.

Thank you!!!

You made it to the end, thank you so much for your continued support and being a paid reader of my material.

I make these guides through hard work - they are a reflection of how I consult with companies, if you want to work with me or have feedback please reach out at producteawithleah@gmail.com

Epic, thank you for sharing all this Leah :-)

Hi Leah, looking at the analytics tools, is Mixpanel your preference when it comes to Mixpanel vs Amplitude? I'm guessing because of Mixpanel's ability to track users across different platforms.