Leah's Product-led Growth Guide 3.0

"Show. Don't tell".

The following material is officially included in an MBA Curriculum at a US University. It is part of a bigger series covering all company stages.

Cohort Learning: Join my live cohort at Maven.com to learn in person with me!

Premium version (same content): This guide is available as a premium 51 page PDF version at Gumroad

Hi, my name is Leah Tharin and this is my Substack: hot takes on product-led growth/sales and organizational scaling.

I advise companies on how to not burn everything down in the process.

This guide will get you started on product-led growth and give you a fundamental understanding of the inner workings of

Why it is so relevant today

What it takes you to get started with it in a team or organization

How the approach differs in B2B from B2C

Combining Product-led Growth with Sales-led Growth to optimize your pipeline

Table of contents

What is product-led growth and why should you care

1.1 Other industry leaders’ takes

1.2 The science behind product-led growthWhat does product-led growth look like in action?

2.1 What are the marketing implications of product-led growth?

2.2 Implications for Sales

2.3 What are the product implications of product-led growth?

How to adopt the product-led growth approach

3.1. Is product-led growth the right fit for you?

3.2. Applying the product-led growth approach

3.2.1 Optimize your data setup/experimentation infrastructure for product-led growth

3.2.2 Re-thinking your organizational structure

3.2.3. Structure supplier contracts for product-led growth suitability

3.2.4. Applying the product-led growth approach: a quick summary

3.3. Shifting to a product-led approachB2B vs B2C archetypes: do they matter in product-led growth?

4.1 Are B2B customers acting like B2C buyers?

4.2 Enterprise and other market adoption behaviorProduct-led growth vs sales-led growth: a quick recap comparison

1. What is product-led growth and why should you care?

Defining product-led growth is somewhat tricky. The concept has changed so much over the years - the term was used only in a B2B context at first!

Still, we can isolate some common talking points:

In its purest form, product-led growth is one of many distribution models you can use to reach your users.

This transparent model places the product - what your customer values - at the front and center of your sales and marketing efforts. It depends on the product itself to do the selling by way of its features, performance, and use cases.

Display as much value as humanly possible to your users before guiding them towards any human interaction, like sales or demand payment.

In the right conditions, this is THE most cost-efficient method we know of to acquire users in a given market segment. Focusing on low friction, it’s a defendable moat that keeps you floating above companies that only acquire users through high CAC-related models like a sales-led approach.

Product-led growth blurs the line between product & distribution. It offers an alternate set of conditions to measure and understand customer value by - one that feeds back into development.

What it doesn’t do is replace the sales-led or marketing-led approach completely. It is one tool of many to utilize.

1.1 Other industry leaders takes

”In product-led growth, users acquire other users, effectively acting as marketers. They’re led to purchases or upgrades without a human touch, and their usage can trigger more usage. This is often because the product is attuned to their interests or needs, which leads to increased personalization or value.”

Elena Verna, Head of Growth @ Amplitude

“PLG presents a disruptive business model advantage for the attacker and substantially decreases disruptive risk for the defender. It’s very difficult to undercut the price if the opening use case costs $0. By the time the user’s economic buyer gets involved, the selling organization has created tremendous switching costs.”

“Product-Led Growth changes how companies grow because it brings a focus on how the product you've built can help you acquire more customers. Customer acquisition doesn't just become something marketing is focused on, the responsibilities for acquiring great customers expand to the product team as well”

Wes Bush, Author, and Founder of productled.com

1.2. The science behind Product-led Growth

There have been some studies already on the efficacy around self-serve motions which are coming from product-led growth, they can be an important starting point to generate buy-in in certain industries.

While product-led growth is not “just” about self-serve it is a big part of it:

[...] Trust is a crucial factor in B2B relationships and can have a significant impact on the adoption of self-serving products in enterprise markets."

"[...] The results indicate that consumers who feel a sense of control over the technology are more likely to adopt it and be satisfied with the self-service experience."

"[...] results demonstrated that self-service technologies can indeed lead to customer satisfaction, especially when they are easy to use, reliable, and save time."

"[...] results indicate that consumers who feel a sense of control over the technology are more likely to adopt it and be satisfied with the self-service experience."

2. What does product-led growth look like in action?

If we boil down PLG to one phrase it’s

“Show, don’t tell”

And therein lies the challenge. Showing the use value necessitates trust in the quality of the product, but, crucially, also in how easy it is understood without assistance.

What are some ways to achieve this?

Trials/freemiums / reverse trials: Expose your product without any expectation of upfront payment to realize value as early as possible.

Ease of use from the get-go / short time to value: Given the absence of human touch, products should be optimized for adoption and self-onboarding. Carefully optimize your wording for comprehension. Highlight table stakes functionality.

Transparency: This applies to everything, from no-BS pricing pages to ready-to-use demo accounts, complete with sample data so potential customers can see as much as possible without plugging in their own data

An emphasis on product recommendations: Current customers are a vital part of further customer acquisition.

If you’re looking for examples of product-led growth in companies, check out the additional reading material at the very end of this piece (that’s Section 7 for you.)

2.1 What are the marketing implications of product-led growth?

(Traditional) marketing-qualified lead (MQL) pipelines are inherently inefficient.

Because they don’t demonstrate value, but explain it in a long-winded process involving salespeople at every stage of the buying process. And still, marketing influence is limited to the top of the funnel. A lead is generated through some messaging and then handed off.

This stands in stark contrast to the strongest driver for closing a purchasing decision - the customer actually using a product, finding a solution fit, and considering it superior to their existing solution.

That’s product-led growth in a nutshell. Value realization happens much earlier in the user journey. What’s more, it allows marketing incredibly targeted access throughout the user loop.

Marketing messaging can happen inside the product

Free users make for excellent product analytics. Understanding what makes any user convert is a great indicator of what Marketing should double down on.

Your marketing should feed into the self-service impulse. More informational content marketing to educate potential customers and lure them into trying out the product. More detailed, user-friendly product documentation, tutorials, and support resources, so they have as much information as they need without resorting to a sales representative. More interactive social media marketing that garners feedback.

2.2 Implications for Sales

Does product-led growth mean you gut sales?

If you’ve been paying attention, you know the answer’s no!

>95% of businesses that distribute through product-led growth have a sales department.

Mature companies increasingly employ product-led sales for higher close rates, by leveraging usage data as an indicator of customer success:

Higher close rates

Access to product analytics

(See the end of this article for more in-depth info on product-led sales).

2.3 What are the product implications of product-led growth?

Product is everything.

No more hiding behind a bad product. How can you? You’re tracking customer outcomes.

Ideally, all product development must now prioritize optimizations for the customer, not for the number of features shipped or some ominous scorecards.

Product is arguably the most affected variable by the decision to adopt product-led growth. It opens up a new quantitative, evaluative stream of feedback. If done right we don’t have to guess anymore. We will know what matters to our customers.

In my book, this blows any other approaches like product sense and intuition out of the water. It’s essential for successful scaling.

3. How to adopt the product-led growth approach

There is a lot that goes into determining whether product-led growth is right for your product or service, and then changing your processes and organizational structures so they’re all good and aligned. Meaning it’s not a decision to be made lightly.

That said, even if you don’t adopt product-led growth in its entirety, there’s a good chance you can still leverage some aspects of it in your organization, as you’ll see further down.

3.1. Is product-led growth the right fit for you?

Of course, not every product or company is suited to product-led growth. There’s a bit of an art to figuring out the favorable and unfavorable conditions for PLG.

Take the following factors into consideration before taking the PLG dive. It’s a comprehensive list. I’ll get into how you can make the leap to product-led growth at the end of the section:

3.1.1. Your product, business model, and market

The first consideration is the base product value fit.

Does your product serve a recurrent need? Can your solution be experienced in a short time? Can it be explained easily?

If you answer no to any of the above, things could get dicey with a product-led growth approach. One-off purchases do not create stickiness and are hard to analyze in a PLG setting.

If your product is in a new category, there’s a chance you can’t yet explain it within a few words to anyone, and they can’t explain it to others either. This could kill your word of mouth.

That doesn’t mean you will never be able to go with product-led growth. But your market needs to have a certain level of existing acceptance for your solution first. Product-led growth cannot help you distribute efficiently to a market that first has to be convinced a problem exists at all!

Product-led growth is therefore a great fit for commoditized or commoditizing markets.

Product-led growth works great in high-account, lower-lifetime-value markets due to how it serves the product.

SaaS business models are a natural fit for product-led growth. No installation, cloud-served and often paired with a low-risk subscription model.In general hardware or advertising business models where there are no recurring customer connections - it’s hard to run any sensible PLG distribution under those conditions.

3.1.2. The stage of your company

The smaller you are, the better product-led growth distribution is for you. There are too many companies and product conditions that need to be fulfilled for successful PLG, and well, some of them are difficult to change at a later stage.

Tough to teach an old dog new tricks. Easier to pivot to a product-led growth model before you grow too much.

That said:

if you’re still figuring out how to make your sales-led or marketing-led approach work, maybe hold off until you have a sustainable motion.

So the oversimplified answer is if you’re small or starting to grow, go for it. As with everything, product-led growth presents opportunity cost and risk.

However, certain aspects of PLG can be applied without implementing it in its entirety. Tracking behavior and customer value-related metrics are never wrong. The easiest way to leverage those is through outcome-driven goal setting. (See 3.3.2)

3.1.3. Your distribution focus

Let’s say you’re confident you’ve found your product market fit and are ready to move on to distribution. Now it’s time to decide where to put your chips and think about scaling.

Foremost in your consideration at this point should be your ICP (ideal customer profile). What kind of customer(s) retains best? Without understanding this, you’ll forego initial product-market fit.

Practically speaking, it’s easier said than done to know exactly where you are. One commonly-used framework by Superhuman determines product-market fit by the percentage number of users that would hate it if you take the product away. If it’s above 40%, congrats! You have PMF.

Finding and supporting your ideal customer profile through product-led growth

In the next subsection, I’ll try to make a case for a good data infrastructure. Knowing your ideal customer profile is not an outright prerequisite for product-led growth. But I’m convinced that this kind of preparation helps you execute product-led growth activities like trials and freemiums. And those can help you find your ICPs.

So for instance, instead of a big blob of customers that retain at 13% over 8 weeks, you might find that certain sub-segments retain better than others.

And, double whammy: if you invest through marketing and product development, you could raise your overall retention over time → you might find your ICPs by focusing and gaining visibility through product-led growth.

This is a great asterisk to the notion that product-led growth is “only” a distribution model. It does offer superior distribution, yes. And it offers so much more.

Additional reading: should you fire your non-retaining customers?

Firing non-retaining users can actually help you find and scale your actual ICPs. Find out more here:

The cost of scaling non-ideal customer profiles

3.1.4. Chain of evidence for PLG

Your general framework must make sense in the context of what you need to prove for a PLG-driven distribution to be able to scale. It allows you to focus on what matters without overdoing anything else to far in the future. Don’t scale or monetize if you can’t retain free users.

The following loop has to be proven in sequence:

Free User Acquisition: Can we acquire enough users through repeatable measures? → This proves our value proposition is interesting enough and people can find us.

Free User Retention: Can we retain enough users? → Is our value experience good enough to retain users and have them return to the product?

Monetization: Given enough people are retained for free, can we find a price that users are willing to pay for the product that is worth it for us and them?

If 1-3 can be demonstrated and proven, you are ready to scale with product-led growth by pumping up your acquisition and optimizing retention/monetization continuously through growth-oriented teams.

3.1.5 Establishing product-led growth Fit: a quick summary

Base product fit: PLG best suits products that serve a recurrent need, and can be experienced and explained easily.

Market fit: Commoditized markets that are high-account, lower lifetime value are a great fit. Hence the SaaS alignment with PLG.

Company stage: Small, new companies find it easier to adopt PLG distribution. Larger ones can adopt product-led growth at a later stage as well, but they’ll have more considerations.

Distribution focus: Understand and support the ideal customer profile to leverage product-market fit.

You can read more on whether you should shift to a product-led growth approach here.

3.2. Applying the product-led growth approach

3.2.1 Early Adopters and their different behavior

Early adopters are not only a small portion of your market. They *behave* differently. They not only want different features they also seek out new solutions actively. And that can go through all segments of B2B too. You have a CMO in a big corp on the bleeding edge of Martech, trying to level up their org. They are early adopters.

There might not be many but they are there. And they will actively search for new solutions. That's why you can push a perfect distribution focus to the side at the beginning and focus on creating a great product. Prove that you can retain them (finding PMF) and you're off to the races.

We are in scaling mode:

3.2.2 The party is over. Hangover is here

Suddenly trying to address more of the same aka "scaling" means the party suddenly stops because of a lot of unfun stuff:

Legal

Scaling infrastructure

Geographical oddities

HR problems

Thrashing

Defending existing growth

This is especially relevant for ANY product-led business. Shifting gears from PMF to GTM will hurt.

It's not your competition. It's whether you can stop your organization from breaking down while you try to build your product suddenly for a majority that's looking for a sustainable, stable solution.

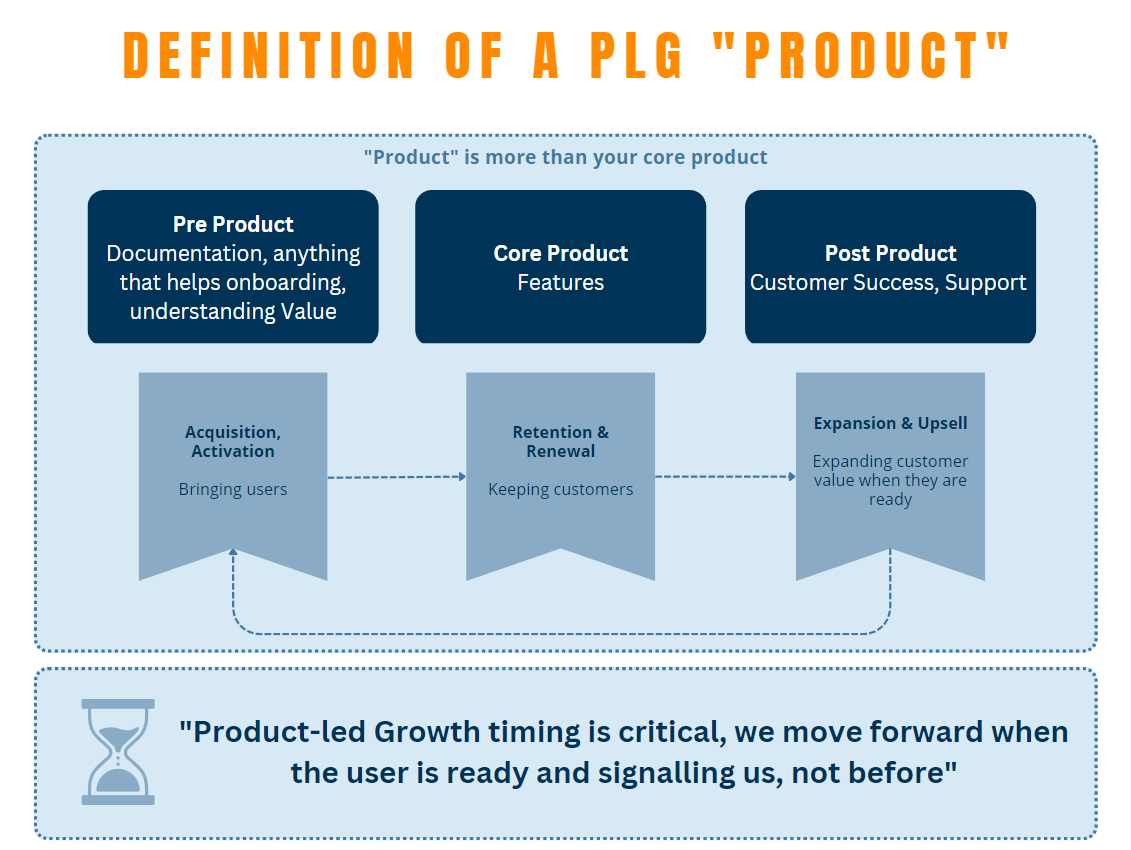

And for that, you need to expand what you understand under "product". It's including the post and pre-experience, not your features.

3.2.3 Optimize your data setup/experimentation infrastructure for product-led growth

Product-led growth acts best in high-volume, high-interaction markets. That means the PLG approach receives and works with a lot of data. And it becomes more important to understand what we deem an unmistakable signal for customer value than just tracking the number of clicks a page has received.

One common framework that illustrates this is the separation of success moments; these will be different for every product.

For example, a simple document management platform could look like this to start:

Setup Moment: The moment when a user uploads a file. → They are ready to go and interact.

Aha Moment: The moment a user modifies and downloads a file. → They’ve realized the value of the product.

Eureka Moment: A user invites other users to edit the file with them. → Not only did they realize core product value, but also additional in-built values like “collaboration”. This is an important signal that they are buyers.

Habit Moment: A user processes more than 3 documents/day over 30 days. → These guys are likelier to stick with you and become buyers!

Other important metrics are tracking engagement (frequency of usage), and 1 / 7 / 30-day retention depending on the frequency of use cases your product addresses.

Whatever the metrics are, they let you segment your data by another criterion and therefore analyze their behavior separated from other noise.

The ability to track cohorts to visualize their retention is very helpful. Knowing which activities did what makes it easier to overview what works and what doesn’t.

Value capture/value creation separation

By measuring customer outcomes over pure business and other standard metrics, a business can differentiate between two categories of metrics:

Value creation metrics are just what we talked about before. Metrics that indicate a value without giving you an accurate picture of $ made.

Value capture metrics are usually tracked well by most businesses. They give an excellent overview to tracking company performance and are a table stake for finance and the C-Level. Examples include revenue, recurring monthly/annual, churn, etc.

While value capture metrics are great to understand business performance, they make for bad team goals to influence the product, especially in a product-led growth setting.

A single team might be unable to see their direct impact on revenue - that visibility is clouded by fluctuation, seasonality, and all the other teams influencing it.

Directly targeting capture metrics incentivizes bad behavior. After all, we can drive down churn by switching off our support hotline so users have a harder time canceling their subscriptions. There will be short-term uplift as a result but your business suffers drastic consequences in the long term.

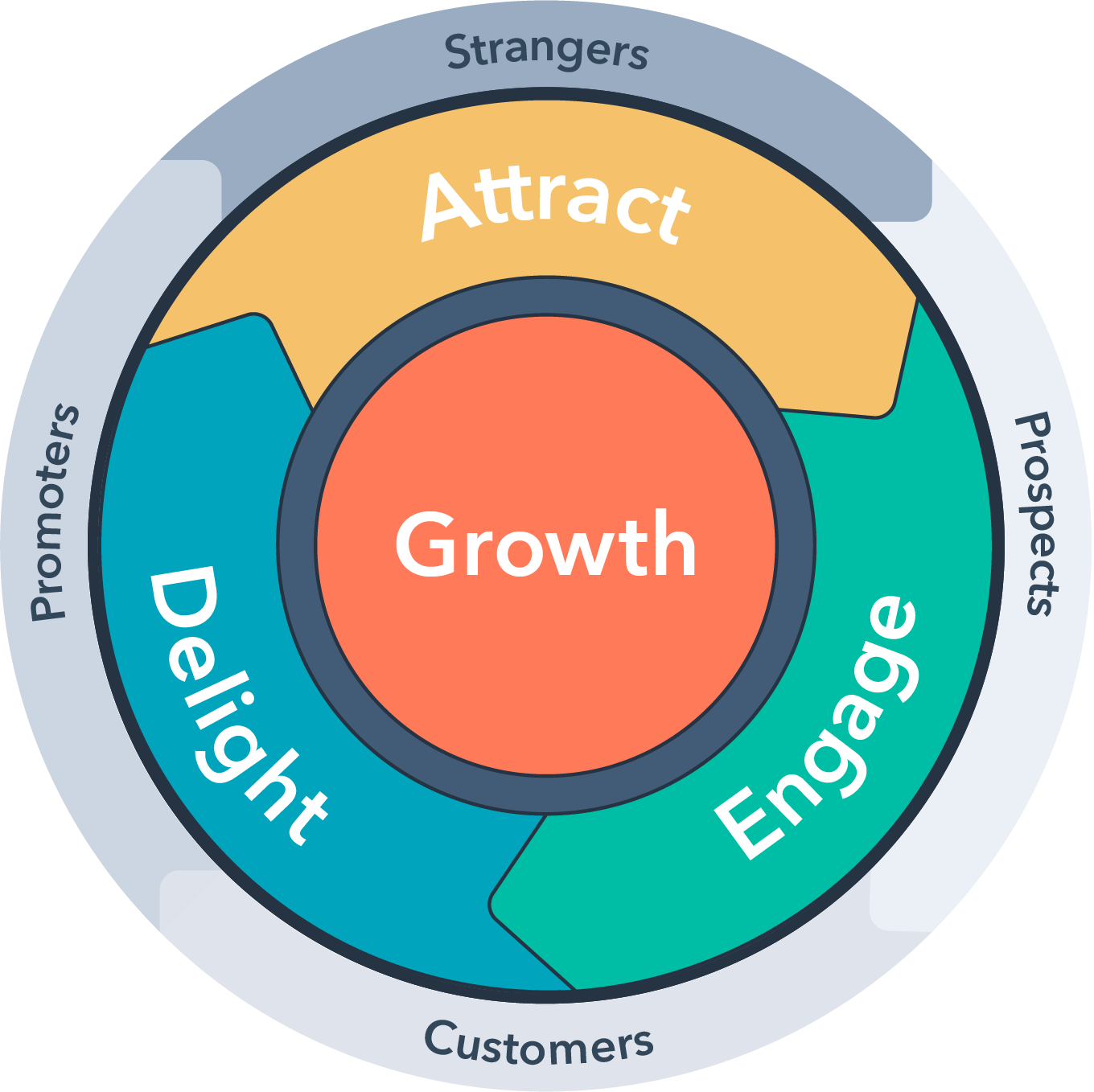

Loops and flywheels

Instead of looking at user behavior like a funnel that ends somewhere, try understanding it as an ever-revolving loop or flywheel. Your customers are, especially in a product-led growth environment, those who help you drive further acquisition.

And they do this through recommendations, reviews, and word of mouth. By analyzing and monitoring these different touchpoints, product and marketing teams can reduce friction so it’s easier for users to

Engage with your product…

…become promoters…

…attract other users…

…who engage with your product…

and so forth.

Loops also serve as great focus areas for product teams. Thinking about a specific loop lets your team operate in a different context than when you’ve split your product up by features.

Outcome-driven goal setting

If you’ve separated your metrics as discussed in 3.2.1.1, you’re ready to target outcomes for your product.

The delivery of a feature is not the goal of an OKR anymore; delivery is the means to a bigger goal.

How does that make a specific difference in the day-to-day though?

Let’s look at the example of 2 teams. They’re the same for all intents and purposes but have different types of goals. Let’s imagine this is a document editor app for your mobile phone:

Team 1 Goal (Output): “Ship an offline mode of our application by the end of the quarter.”

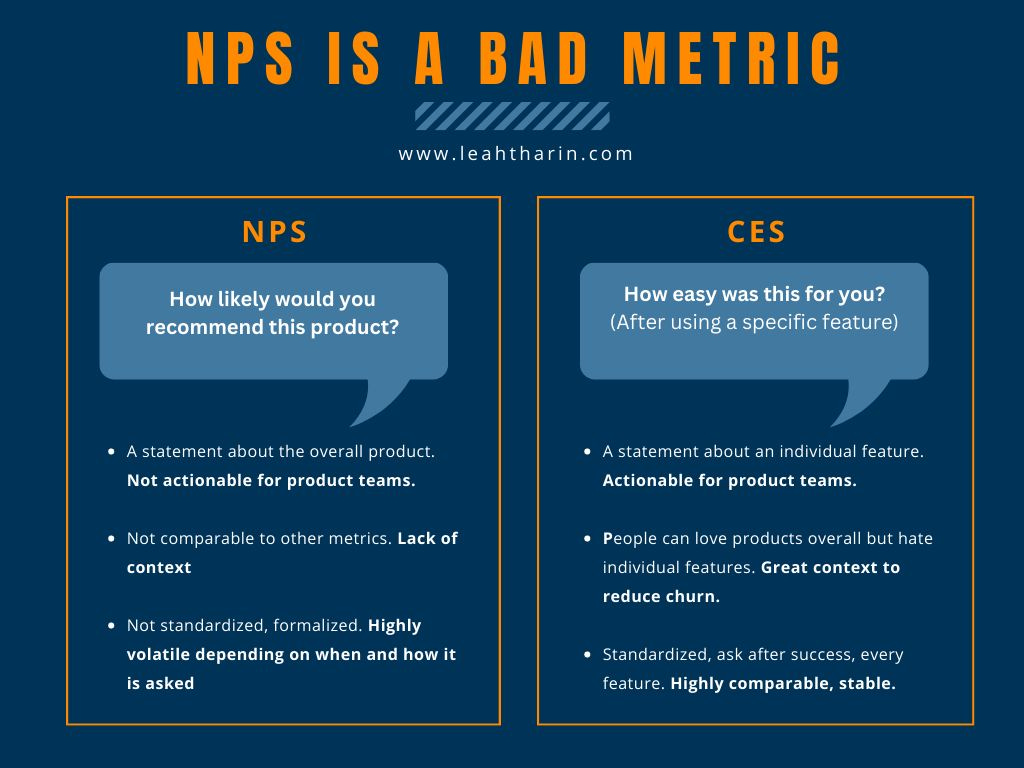

Team 2 Goal (Outcome): “Increase the NPS rating from customers that use our product by 15 to 70.”

Both teams might decide that shipping an offline mode is the best measurement to reach their goals.

For Team 1, it’s their only goal - they were told to do that.

Team 2 might come to the same conclusion based on usage data and customer feedback centered around constantly losing documents and giving them bad ratings.

Uh-oh, is Team 2 about to be left in the dust?

Not so fast.

The main difference is that team 2 might notice that their base assumption is wrong during the quarter. They’ll know something is wrong due to the low NPS but their prototypes are not being as impactful as they expected:

Is the problem not as bad as they thought?

Is the solution to it the wrong one?

So they go back into research. Their goal is not to ship but to fix the NPS.

They still have a chance to reach their goal while Team 1 just builds into the void.

Sidenote: NPS is rarely a good target. A more granular CES (Customer Effort Score) rating or straight-up usage metrics might be better. This case is just to illustrate a very known metric.

3.2.1.3. Documentation and learning

Team 2 (see 3.2.1.2.) learned something. Their solution might not be the obvious solution to a problem they identified. But they learned this through experimentation and monitoring the metrics they tried to influence.

It is crucial to store, document, and have the ability to access these past learnings and experiments. Otherwise, you will repeat the same mistakes. There is a certain danger in making absolutist statements on initiatives and learnings, but lack of documentation is a huge sin.

One good approach to storage is to tag past initiatives and experiments with a) what part of the funnel they affected, b) the effect on acquisition and retention, and c) which part of the product was altered. Whatever helps you find it again without context in the future.

3.2.1.4 Further resources on data

This article by Olga Berezovsky goes into depth on cohort retention:

3.2.4 Re-thinking your organizational structure

Directional vs supportive

Understanding customer behavior is not easy, and product-led growth gives you a lot of it to track. It is a constant cycle of learning, interviewing, and deriving incremental value through fast flow.

Attempts to lead from the top without working with this data every day sets you up for failure. Your operational teams do know better. We need support in the direction we’re taking, understand bigger market movements, and align teams around that instead of trying to control them.

Team structure

Ditch any thoughts on matrix organization (unless you have a complex business structure like hardware robotics with separate interfaces).

You need cross-functional teams that understand what they are doing and care about context.

Separating people by functions kills any alignment. If people don’t care they won’t understand:

Additional material: how to build organizations for fast flow and effective scaling

An episode with Matthew Skelton, Author of “Team Topologies”: we dive into what an organization based on collaboration means and how our old models just don’t work anymore.

“Team of Teams” by General Stanley McChrystal is a foundational case for transparency and autonomy in organizations and why it works.

3.2.5. Structure supplier contracts for product-led growth suitability

If your business is licensing another technology provider (API, SDK) to provide value on the platform, be careful about how these contracts are structured.

Usage-based contracts: The supplier is charging you by the number of calls you make to their API or how many times you use their SDK.

These contracts are inherently flawed for any product-led growth model because you will have a lot of free users that just never convert. In some B2C markets, conversion ratios are as low as 0.1% → 1000 uses for 1 paid use.Revenue share contracts: These are suited well enough for product-led growth because you get paid for your customer’s success. I understand the resistance to tying your revenue to suppliers in any way, but this is increasingly becoming a new reality.

My favorite example is Unreal Engine (a gaming engine to develop games). They charge a 5% royalty on any revenue above 1 Mio. Before that, it was essentially free.

Flat contracts: They also incentivize lower CAC to optimize unit economics but they become increasingly rarer as businesses wise up.

3.2.6. Applying product-led growth approach: summary

Optimize your data setup and infrastructure for product-led growth: figure out user moments to codify within your setup, and prioritize value creation metrics.

Loops and flywheels: funnels are out. Monitor different touchpoints to draw users into attract, engage, and delight phases.

Outcome-driven goal setting: feature delivery is no longer an OKR, but a means to a larger end.

Document the experimentation process: to access past learnings.

Re-think the organization structure: so it’s more cross-functional and supportive of operational teams.

Structure supplier contracts for product-led growth suitability: through revenue share contracts.

3.3. Shifting to a product-led approach

As you’ve seen by now, it’s easiest for a new or small organization to adopt product-led growth. As long as you’ve:

invested in the research and development to create a product that your ideal customer profile will enjoy experiencing and,

Incorporate customer feedback into product development

you should be able to structure your operation along product-related growth lines.

Shifting from a marketing or sales-led to a product-led growth strategy will involve more pronounced operational changes. Here’s how you keep your eye on the ball:

Prioritize user-driven product development and innovation: Dedicate your resources to research and development. No way around this. Also, foster a customer-first culture that emphasizes user feedback and customer service.

Align sales with product-led growth: When the emphasis is on product promotion, you can’t rely on the same old sales tactics anymore. Your marketing now depends on product demos and trials that encourage customer referrals.

Align marketing with product-led growth: Cater to the self-service impulse through informational and interactive content and social media marketing that both educates potential customers and is feedback-oriented in itself. Offer detailed and user-friendly product documentation, tutorials, and support resources.

Realign organizational structures: You know what this means - restructured departments and teams, and new process and tool implementation. Supportive over the directive. Cross-functional over Matrix

Revise your metrics: You are all about value creation now. Shift to metrics like product usage, retention rate, customer satisfaction, customer acquisition cost, and net promoter score.

Prepare yourself for product-led growth to change your product. Prepare to adapt to user behavior. Prepare for a cultural shift.

Prepare to create a product that’s in charge of driving sustainable growth for your business.

4. B2B vs B2C archetypes: do they matter in product-led growth?

4.1 Are B2B customers acting like B2C buyers?

Well, no, and yes.

According to a report published by Considered Content, about 66% of B2B buyers “are now self-serving more information before contacting vendors.” And “53% of buyers would prefer to buy without any interaction with sales at all.” The data is in: self-service B2B buyers are on the rise.

And we are far from the saturation point on self-service.

This is especially as organizational structures pivot to cross-functional teams, leading to more independent business units. The end users in these business units become more influential when it comes to buying decisions. (See product-led-sales 6.2)

The simplified story: if you have a choice between multiple tools for your use case and one is a PLG contender, why would you even bother calling up the rest if you can check out the PLG tool first?

That said, your product may still face some systemic constraints to self-service. Like:

Size of payment requiring some form of corporate governance process/due diligence

Complex asset-driven products that necessitate assistance with complicated integrations through a sales rep

Complicated niche products that require custom-tailored onboarding before they can deliver value

Software adoption difficulties for enterprise solutions. One reason SaaS is aligned with product-led growth is that the former is easy to integrate - after all, a private user can simply start their browser and log in. However, an enterprise deployment might require far-reaching integration, changes of guides, and processes at scale despite that ease of use.

So even though B2B buyers have different needs that can be self-served, they can and should still be served like B2C buyers on the distribution side where required.

4.2 Enterprise and other market adoption behavior

For B2C and most mid/lower B2B segments, the issue of adoption pain has been largely addressed through modern SaaS / PLG solutions. Most products can be used by logging in to a browser - there’s not even a need for setup.

As I said, there can be some exceptions for enterprises that can make the self-serve route more difficult. But there’s more going on than just that.

For mixware products - that’s products with a hardware component and a software interface (like robotics or high-tech hardware like photo cameras) - there is an interesting, visible shift that gives them a higher leverage over customers than what you’d expect.

This involves the recognition that a product is more than just the “product” itself, but also the pre, post, and integration experience. Meaning even hardware-focused companies can employ the motions of a product-led approach (though not the entire PLG process):

Robots-as-a-service monetization models create leverage by de-risking the consumer. This answers an important question for enterprise customers: cost predictability. There’s an additional non-customer incentive to keep units running to drive your own operational cost down.

Parts of the experience can be served beforehand to some degree. The software part (like an interface) can be integrated into the standardized APIs and asset management tools that almost all enterprises use.

What keeps the PLG / PLS territory far out of the reach of enterprise robotics is that complex machinery is still subject to old systems like customs and local supply chains. And this will likely still be the case in the future due to non-standardized parts usage.

The broader point is what optimized organizational structures have facilitated: a shift towards more self-service-oriented, product-led growth behaviors - even in the most formerly sales-led of products.

5. Product-led growth vs sales-led growth: a quick recap comparison

How it works

Product-led Growth:

Self-service model that lets potential buyers experience the product before making a purchase decision.

Uses trials and freemiums for a wider top of funnel, and prepares more qualified leads for conversion

Sales-led Growth: Personal assistance for all leads throughout the buying journey

Who’s it for

Product-led Growth:

Organizations with:

a strong product

a clear value proposition,

a focus on customer experience, and

that operate in fast-moving and competitive markets

are good candidates for product-led growth. SaaS companies will often benefit from this approach due to a natural fit.

Sales-led Growth:

complex products that are hard to explain without a personalized sales process

organizations in markets with long sales cycles.

What it requires

Product-led Growth:

A contextual, engaging product experience that can convert customers

Continuous customer feedback collection for ongoing product improvement

Curating a community of users and advocates to provide feedback and support to each other, and help drive word-of-mouth referrals.

Understanding customer behavior through data and analytics

Radical transparency to value and cost wherever possible

Sales-led Growth:

Hiring and training a sales team to persuade potential customers into purchase through high-touch

Using insights from sales data and metrics to improve the sales strategy

Success Metrics

Product-led Growth:

Prioritizes value creation metrics:

A high user acquisition and retention indicates the product is providing experienced value

High conversion rate, usage, and engagement speak to the product’s ability to promote itself

A high net promoter score indicates the product is driving referrals

Sales-led Growth:

Prioritizes value capture metrics:

Low customer acquisition and retention rates speak to marketing and sales effectiveness

A high average transaction value indicates success at upselling and cross-selling

A high lead conversion rate indicates effectiveness at closing deals

6. PLS - Product-led sales

(An in-depth PLS guide will follow later in 2023)

Product-led sales is the logical continuation of product-led growth.

It introduces touch into the mix - where it matters.

In general, the same principle applies. We “touch” the customer as late as possible. Where the difference in approach is most noticeable is sales close at a much higher rate. Because they now understand what customer success means, and are ideally also incentivized on it.

6.1 What edge do product-qualified leads have over marketing-qualified leads?

PQLs address the obvious weakness of (traditional) MQLs. Namely that with the former, leads/accounts are “ranked” and then approached based on their behavior with the product.

If an account shows “successful” buying behavior, they might not only close but also retain for a long time.

A popular example in this regard is Slack’s 30-day metric:

If a customer is sending 2000 messages within 30 days they are very likely to stay for a long time

Sales can be incentivized in this direction. The success of the customer gains importance, simply compared to the size of the account. We can even reward later expansion beyond the initial deal size.

Meaning Sales will now take care of their existing customers far longer than just until they sign. → This improves retention and LTV.

There is an inherent danger, though, when pivoting an existing sales organization - there might not be enough product-qualified leads to feed everyone.

6.2 The Effects on an individual buying decision

Contrary to what you may believe, product-led sales hands you more control over an individual buyer's decision than sales-led, not less.

You might have fewer leads (initially).

Buying decisions may take longer the more transparent you are.

However, the transparency entailed by no-touch shows low-quality leads out all by themselves. “Convincing” those leads by optimizing sales pitches alone is just an illusion.

PLS, done right, empowers your sales team to leverage user data. There’s a shift from basic questions to targeted conversations. This leads to better product development as product usage data is a table stake for great experimentation.

Better product-market fit.

6.3 Product-led Sales in Depth

7. Summary

That decision to dip your toes into the waters of product-led growth may seem daunting. But despite the challenges and learning curve, it may well be a worthy one.

As you’ve learned, product-led growth:

Is an extremely cost-efficient method to acquire customers

Helps you understand users not as an ever-decreasing funnel but as a flywheel/loop, an integrated part of future user acquisition.

Can be a powerful method to guide product development.

The deeper you get into PLG, the more you realize how complex it can be. I've dedicated my career to helping companies get it right, so here are some resources I've built for that purpose:

My Maven Course on PLG for B2B - The next step up is to join me in a cohort to learn more about product-led growth. With a 9.7 rating (2023) this is the top-rated course on Maven in this category to learn how to drive measurable impact in your growth channels.

Advising - I advise companies on how to get PLG right on monthly retainers. Please reach out if you think I’d be able to help.

(New!) Growth as a Service - If you want to bring PLG into your company on a team level check out my new service around Growth as a Service where I bring a former team of PLG top performers to help your teams out until they are good to go.

8. Additional reading material

1. Elena's Growth Scoop

Focusing on B2B growth, including product-related growth/sales. Elena Verna's frameworks are very well-structured and visualize complex interdependencies in a simple way.

Elena’s most quoted product-led growth output is her 3x3 growth model menu which serves as an overview of where to put product-led growth in relation to marketing-led and sales-led:

2. The Product-Led Geek

Ben Williams is a force to reckon with when it comes to Product-led anything. His actionable frameworks are detailed and thorough. The devil is in the details and Ben’s frameworks are a great way to get them right.

Fantastic content, thank you for sharing this hard earned knowledge!

This is such an amazing article. I instantly had to recommend you to my subscribers after reading this.