The 250k per Employee cultural KPI causing layoffs in tech

Why our jobs will always be an uncertain bet

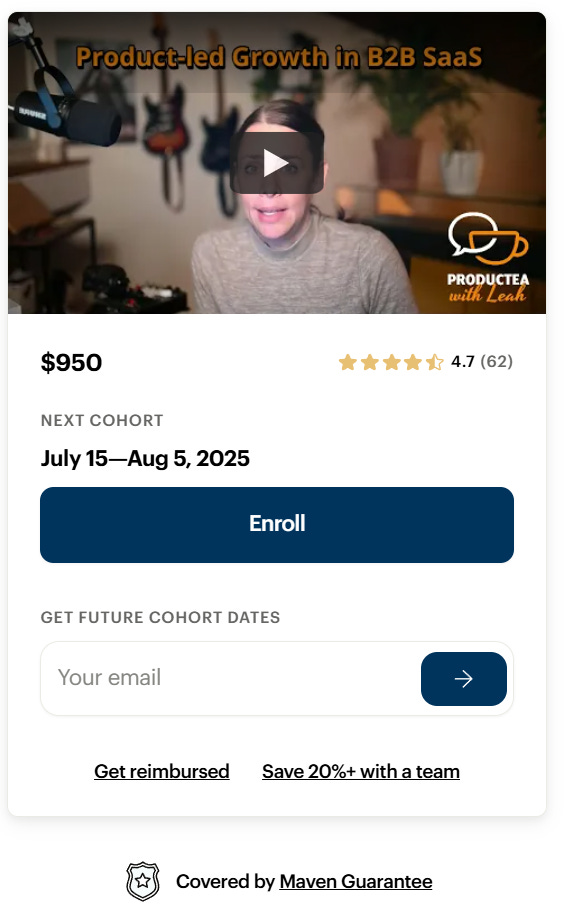

Join my next cohort on Product-led Growth in B2B running from July 15 - Aug 5, 2025

The short summary of what’s happening right now in SaaS:

SaaS companies above >$1M ARR in the US,

2020: ~5,000 (Pre-pandemic, pre-AI) (48% of those with PLG)

2025: ~15,000 (Post AI, PLG Efficiency) (72% of those with PLG)

Or if you want to have it even more condensed:

There’s more and more SaaS companies trying to get money of the same cake and there are no signs of that slowing down.

The ones that do become profitable also tend to grow much faster than before. More companies, more jobs, and faster growth…

The structure of most SaaS / PLG businesses is that ~70% or more of all costs are staff-related.

People like you and me.

This hasn’t changed much despite AI now being overall a bigger cost centre. Most SaaS companies are still run by humans.

But the founders and investors in those companies are also humans. And they try to control these new companies with somewhat old methods, which are leading to some problems that have plagued our industry for decades.

Understanding those methods can help you understand why it’s so important to think commercially to secure your job.

The “phone call”

The investors who own these companies are facing a somewhat changed reality from previous years in that most of these companies are now dominant with product-led growth as a distribution model.

One main difference from PLG dominant companies is that they are less transparent and harder to control. While you do have more data in a lot of aspects (due to having a freemium, trial), the control tools that we have to scale such motions from the balance sheet are awkward at best.

I teach most of my PLG material for B2B companies with two important mechanisms:

We separate value creation (your product metrics) from value capture (conversion metrics into $) to align our product and growth development with the customer. This leads to better onboarding and longer-term retention as the customer experiences more likely early on what they expect longer term.

For instance, instead of measuring how many visitors we convert into paid ones, we focus on how we bring visitors as fast as possible to the “AHA” moment with our product, which is before payment.

We will always prioritize revenue over internal processes, even if that means that we lose a bit of oversight.

For instance, B2B buyers do not want to give us their email anymore just to read our content. In order to maximize the number of eyes we generate on our inbound material, we remove gated content even if it means less tracking. We also need to take into account the fact that buyers do not follow linear paths anymore.

It’s possible someone calls sales, three months later goes into a freemium, and then closes self-served. We might not be able to correctly attribute this, but we have to build our growth funnels for that possibility.

Both of these mechanisms help you differentiate and beat your competition, but they also make the company harder to control.

A typical Sales-led company can be steered with simpler predictability over its sales headcount due to the linearity of a sales pipeline:

Customer clicks “Call Sales” → Call happens → Demo is given → Lead is generated, etc., etc.

Letting go 50% of your sales people means probably a similar reduction in new revenue almost instantly.

Whereas if you let 50% of your product and growth people know, no one knows exactly what that will do and how fast.

If you want to read more about the inner workings of PLG, read my free guide on the subject, or join me in my upcoming Maven cohort, mid-July 2025:

Investors have since then come up with new metrics to roughly measure company efficiency, and one of the KPI’s they came up with is the amount of revenue a company makes per employee.

This is not a terribly new thing, but it’s often a blind spot for even more senior product and growth people since they never learned the commercial side of any business.

It matters because at some point, Investors will pick up the phone after looking at the balance sheets and talk to your CEO with a variation of the following phrase:

Investor:

“We need to talk about your Q2 numbers. Your ARR per employee is at $150k – decent, but Canva’s at $310k using AI-driven support teams. The market’s punishing anyone below $250k now. Look what happened to HubSpot’s stock after their metrics dipped last month.”CEO:

“We really shouldn’t lay off people right now, morale is already quite low….”Investor:

“Morale doesn’t move multiples. Try the Autodesk Playbook: Cut 9%, blame ‘cloud transformation,’ hire 20 AI specialists. Bamm! Or do what Shopify did, freeze hires and let attrition do the work quietly”Whatever you pick, announce it before our next board meeting. Oh, and if you need cover, cite the EU’s new AI liability laws as a ‘strategic pivot’.

CEO:

”What about our Q3 Product roadmap?”Investor:

Delay it. Right now, we cares about two things: your burn rate and how many FTE equivalents you’ve automated. Did you see CrowdStrike’s report? They replaced 40% of L1 support with AI and got upgraded by Goldman. Be that story.

This fictional call is one that the CEO is getting if your numbers are not too great in the minds of your investors, but you will also get it if you are insanely profitable and have revenue way above whatever the ideal revenue per employee is in your investor’s head.

Then the call will go a bit differently in that your CEO will be interrogated as to why they are not investing the additional money to aggressively capture more of the market. This will lead to aggressive overinvestment practices, which will land you in the same cycle sooner or later again.

This happens because companies in SaaS are being sold based on their outlook and expected performance in the coming years, not just their existing money in the bank.(Read up on “DCF [Discounted Cash Flow] Evaluation” for more info on this.”)

In either case, it’s a reflection and reminder of the purpose of a company: to generate value for shareholders, ergo dollars. Not to employ people.

Hate the player, not the game

We can shake our fists and be angry about the fact that we are being treated as exchangeable resources, or we can try to understand the game better and act within its rules. Whether you are a normal product manager or a product leader:

It doesn’t hurt to think commercially and try to put yourself into a position where any investor (and by extension, your CEO) would think it’s a bad idea to cut your job:

Create a lot of money with as little investment as possible. Don’t just ship things. That’s the best way to protect your job and the ones from your team members:

Don’t just ask as a reflex for more people and resources because it looks good on your CV, be comfortable abandoning ideas because they simply don’t pay enough.

Billion-dollar improvements that never ship because they are stuck in research create zero revenue. Set yourself stringent limits on how long you are willing to research before you either kill or ship a project.

Do good things and talk about them. If you’re creating a lot of uplift with your team, don’t forget to highlight the commercial side of things when presenting it.

It’s cool that you “vastly improved onboarding” and now have an AI agent called “Toby” to help support. But don’t forget to put it into a memorable quote that the CEO can remember by mentioning revenue.Money will always beat vanity. Balancing your backlog with things that have a material effect on the business is your responsibility. You might think that you can’t sleep until you update a section of your internal wiki page of the company because you promised your CEO 1 year ago.

My experience is that good, solid business cases for new stuff are the best weapons to kill old vanity promises that seemed important at the time.

More in-depth reading on the topic of being a commercial PM:

I consider myself to be a pragmatist when it comes to these things, and I do recognize that there are probably some regulations overdue (notice periods, etc.) for a long time in our industry, but focus on what is within your control.

Or, if you are a bootstrapped founder with no investors, be nice to the people you work with, even if it costs a little bit more.

Maybe not everyone should be reduced to a number.

Join my next cohort on Product-led Growth in B2B running from July 15 - Aug 5, 2025