Finding your Ideal Customer Profile in B2B: Interview Questions & Guide

A structured and simple approach to asking the right questions to your ICPs

The critical piece to figure out first in any ICP research is who the person behind the buying decision is.

Most companies get this wrong because they focus only on firmographics and describe what the customer “does” instead of what they really care about. Afterall, that’s all you need to “sell” a product, right?

This makes it impossible for product, growth, and marketing to derive meaningful guidance on what actually matters, so they resort to designing for a general audience rather than a sharp profile.

This, in turn, makes selling your product harder over time because you keep attracting a more general audience rather than just those that matter.

My general advice to start with is to focus on what is common to every good ICP research: the buyer.

If you're selling downmarket, the buyer and the user are very often the same person (or part of a team that uses it). The more upmarket we go, the more likely they become a separate buyer persona that looks wildly different from the user persona. The following interview guide is particularly useful to find and understand the buyer in both cases.

The Art of Finding Your ICP and asking the right questions.

The secret of finding a great relationship in dating or business is always two ways: Do they have what I want, and do I offer what they want? If both of these questions are fitting, then we have found an Ideal customer profile.

In business, that means I can charge enough (my value) because I know my customers really want what I have to offer (their value).

That much is obvious, so how do we figure out the profile of these people?

Imagine going on a first date and asking questions like, "So, do you work in tech or finance? Is your company Series A or post-IPO? How many direct reports do you have?" Sure, these data points might help you filter out some obvious mismatches, but they tell you nothing about what makes someone tick, what lights them up, or whether you'll actually click. (Aka, what differentiates you)

Yet, this is exactly how most product leaders approach their ICP - collecting dry statistics about ARR, employee count, and tech stack like they're filling out a mortgage application. Those ARE important questions to ask, especially when we talk about sales further down the line, but they are not sufficient.

And just like in dating, if you stop at surface-level demographics, you're missing all the good stuff that actually matters about your customers.

To get started, we need to interview our ICPs, no ChatGPT or market report will do this for you.

Who should we interview in the first place?

If you don’t have a more specific idea, we suggest picking existing customers who have been with you longer than 12 months and spend more than your average customer.

For a lack of a better signal, we take their higher spend on your product to be a signal for getting the most value out of your product.

We want more of those customers in particular. The entire exercise of an ICP is about targeting customers who are better than the current average we serve.

Here's a playbook and template to get you started and what questions to ask so you can find commonalities with time that matter beyond dry firmographics.

These techniques are adapted from the upcoming Maven course I’m teaching with Andrew Michael, "How to Find Your Ideal Customer Profile 'ICP' in B2B SaaS." We’ll be teaching growth leaders how to unlock step-change growth through deep customer understanding. Learn more and register here.

Our next cohort starts on the 4th of February 2025.

Downloadable ICP Interview Template

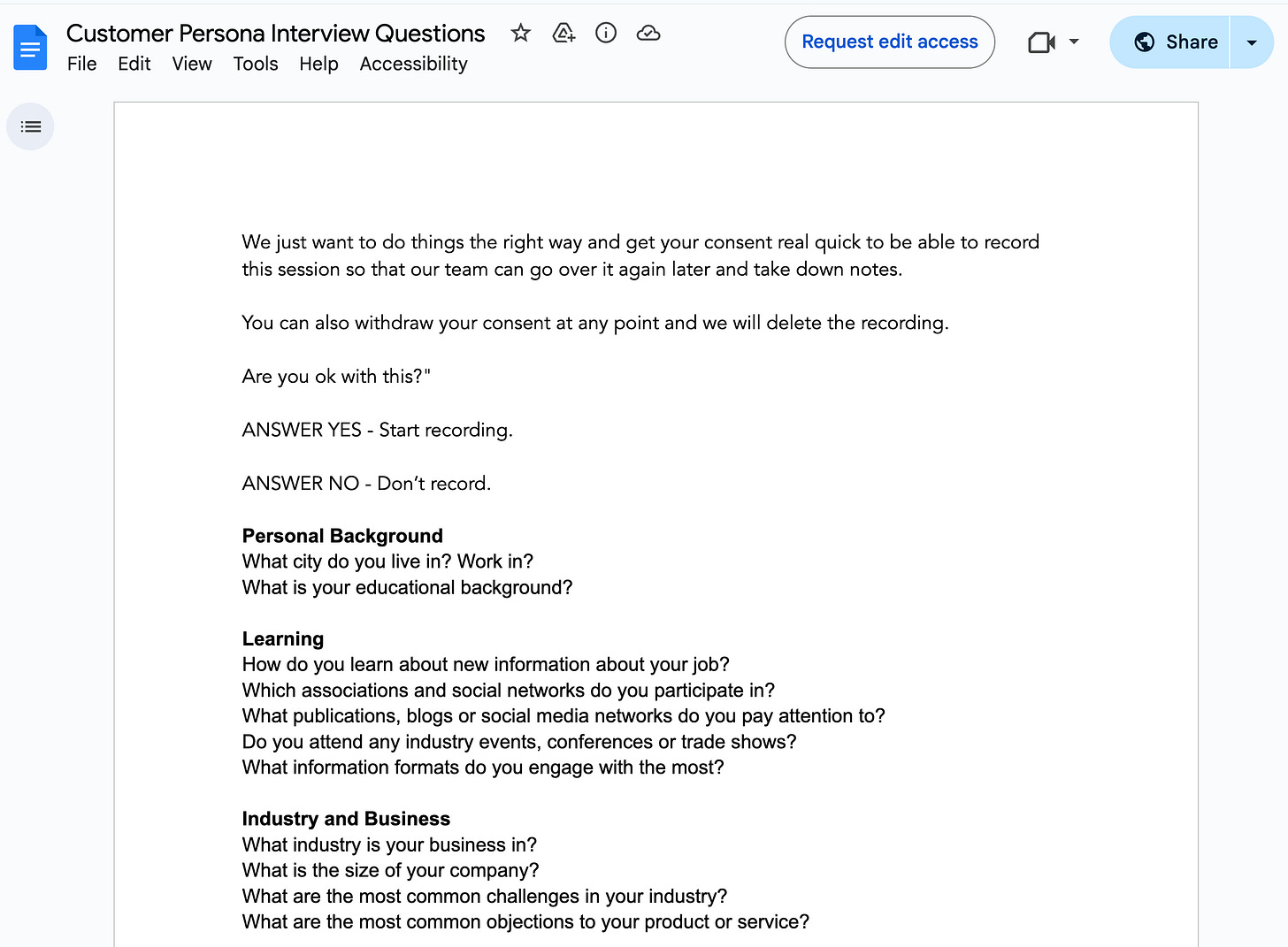

Download a free copy of our Customer Persona Interview Question Template; no email is required. We’ll be referencing this throughout the piece.

Don’t skip the small talk.

The first couple of questions on here are icebreakers. Don’t skip these - they help the interviewee get comfortable and realize that you are a human being, not an AI Agent asking questions exclusively to extract juicy data from their soul.

Start with Learning Patterns

Once you’ve established some rapport, it’s time to dive in.

Begin by exploring how customers stay informed about their industry. The answers are basically all of the places you should be putting your company’s messsage front and center.

Questions:

How do you learn about new information about your job?

Which associations and social networks do you participate in?

What publications, blogs or social media networks do you pay attention to?

Dig into Industry Context

Next you want to learn more about their industry. What are the broad challenges and objections people have to buying things in this industry. A good example is strict regulatory requirements that might make your product unusable in certain sectors).

Don’t focus too much on the interviewee’s specific company just yet - that will come later.

Questions:

What are the most common challenges in your industry?

What industry is your business in?

What are the most common objections to your product or service?

Who are they within the organization?

Understanding roles, responsibilities, and internal dynamics is crucial. These questions help you figure out if the person you’re talking to is:

the economic buyer

the champion of new solutions

the influencer of making buying decisions

Also important here is understanding how the person and their team define success. Wanna make Gary from Sales happy? Get him this info.

Questions:

What is your job title and responsibilities?

How do you measure success in your position?

To whom do you report? Who reports to you?

Gooooooaaaaaaaaaaaaaaals

Don’t just ask about the goals, but really dig into why the goals matter, not just to the person you’re interviewing but to the entire team.

Understanding this information concretely will help you figure out how your product can achieve these goals and how to showcase that ‘aha’ moment for potential buyers via PLG.

Questions:

What are the goals you're trying to achieve?

Why are these goals important?

What steps are you taking to achieve these goals?

What stands in your way?

There’s nothing people love more than telling old war stories of life in the trenches of failed implementations and saving the day from “oh my god did we just push that to production?!” fires.

These stories reveal both the technical and emotional barriers you'll need to address in order to get their business.

What are the biggest challenges that prevent you from achieving these goals?

What have you done in the past to conquer these challenges? Did it work?

If it didn't, what would you do differently next time?

Putting it all together

Now it’s time to figure out how decisions actually get made within their company. Your goal with these questions is to create a clear picture of the stakeholders, timing, and triggers that lead to purchases.

You also want to understand the specific user story of how they found your product, what their ‘aha moment’ was, and what almost stopped them from making the purchase.

Questions:

How do you research new products for your business?

Who's involved in the buying process?

What events led to creating an account?

What nearly stopped you from purchasing?

Summary

Look, you're not just collecting answers to tick boxes here - you're mining for the real stories that reveal why people do what they do.

Plus, that stuff is way more interesting! When you really understand the psychology of why people do what they do, you make the PLG motions happy, AND you make Gary from Sales and Mary from Marketing happy too. And you know what? That makes me happy.

From these interviews alone, you should already learn quite a lot, but most of all, it allows you two core questions about your ICP profiles that is often underserved in a lot of companies that mostly focus only on firmographics:

What are the specific use cases and the jobs we solve for our ICPs?

What do our ICPs really care about?

The above is adapted from a lesson in our upcoming course:

The next cohort for “How to find your Ideal Customer Profile 'ICP' in B2B SaaS,” starts on Feb 9, 2025.

Subscribe to it or get on the waitlist for future cohorts, now:

→ More information and register

Lovely post as always, Leah, but what about when you don't have (enough) customers to derive an ICP from? How do you go about finding out the initial market niche you should focus on?