How to find your first ICP Guide

And the announcement of our new course about finding ICPs on Maven!

This is a guest post from Andrew Michael the show host of Churn FM, additional commentary has been added by me in Italic.

WTF is an ICP?

Before I get into WTF is an ICP, I have to share something that blew my mind today...

I had been using the term acronym wrong my entire career. I used to think we love acronyms in SaaS but in actuality, it’s initialisms.

FWIW, an acronym, typically refers to abbreviations pronounced as words, e.g. SWOT (Strengths, Weaknesses, Opportunities, Threats), while an initialism refers to abbreviations where each letter is pronounced separately, e.g. ICP (Ideal Customer Profile).

So now that you know that KPI, LTV, CAC, CPC, NDR, and almost every other abbreviation we use in SaaS are initialisms and that ICP is an initialism that stands for Ideal Customer Profile, let’s dive into what an ICP is.

What is an Ideal Customer Profile?

An ICP defines the properties of your most valuable customers, while the term “target market” or “total addressable market” includes every possible company that might buy your product or service.

Gartner describes the Ideal Customer Profile (ICP) as a profile that defines the firmographic, environmental, and behavioral attributes of accounts (users) that are expected to become a company’s most valuable customers.

Their definition does a decent job but lacks the depth you need for it to be useful.

In the context of B2B SaaS, your ICP should be a description of the perfect customer for your business.

The customer with the greatest exchange of value, who sticks around longest, and is the most likely to recommend your business to a friend or colleague, or at least lie to you about doing so in an NPS survey, because who really talks to their friends about enterprise software?

In my podcast Churn FM, I have recorded over 260 episodes with execs and operators of the world’s fastest-growing companies, and the single biggest and most obvious reason for churn is that your product is not delivering value to a core audience.

Your customers come to you looking for a solution to their problem, and if you solve it and provide value, they will not churn; it’s as simple as that.

Well, it’s maybe not as simple as that, like most things, there is a lot of nuance in bold statements but your ICP should be the customer who receives the most value from your product with the highest willingness to pay.

Your ICP needs to encapsulate who your customers are from a firmographic perspective just as much as what they are trying to achieve from a value perspective AKA their use cases or JTBD.

Leah’s comment: This is especially true, the more you think about PLG. In product-led growth we spend a lot of time understanding people’s behaviors to influence the majority of them whereas in pure sales-led environments we try to optimize for individual pitches where firmographics are more important.

We care less in PLG (at least initially) about whether the person that is becoming our customer has deep pockets or not, as long as we can onboard them onto the product it’s worth it.

A good ICP drives down your cost for almost every function in the company.

Identifying your ICP ultimately helps you focus on attracting and selling to the right customers and building a product that delivers the maximum value to them, and in exchange, they stick around the longest, spend the most, and spread the word for you.

Not doing so has hidden costs:

Course Announcement_

Andrew and I launched a course, “How to find your Ideal Customer Profile 'ICP' in B2B SaaS,” and it’s live now! And you’re the first ones to know about it.

Since this is our first iteration, we’re giving 30% off the price; subscribe to it or get on the waitlist for future cohorts, now:

→ More information and register

The hidden costs of not defining an ICP

Imagine sitting down to write a 4,000-word guest post on Leah’s ProducTea without considering who will actually read it. You end up with a bland generic post generated by ChatGPT that lacks clear actionable takeaways and any form of wit or humor.

Nobody bothers to read past the first paragraph, they miss your call-to-action at the end, and Leah sees churn spiking on her newsletter, and you wonder why.

Leah’s comment: Hey my subscribers are the best, smartest people ever! They would never churn! 😶

No need to wonder because that’s what happens when you don’t define your ICP. There are hidden costs that span across your business and they can include:

Wasted Marketing Spend

Lower Conversion Rates

Increased Customer Churn

Product-Market Misalignment

Inefficient Use of Resources

Loss of Competitive Edge

And more...

So instead, knowing Leah’s ICP, what you should do is open the post with a personal curve ball to hook your readers in that could never be written by a generative model, deliver key takeaways throughout, sprinkle in some wit and humor, and trust that the intelligent and charming exec/operator in B2B SaaS that reads this will find great value and will not miss the CTA at the end.

So now that we can agree on a few of the characteristics of ProductTea’s ICP and the costs of not defining your ICP let’s dive into how you can define and identify yours.

How to Define Your ICP

Your ICP can be defined in a myriad of ways with various categories that can and should all be tailored to your business and customers’ needs but for the most part there are a set of standard criteria that you can get started with that will give you an indication of the research that will be required to populate your ICP.

For starters, in the context of B2B SaaS, as you are selling business to business when we refer to the term Customer, we are referring to a company. Your ICP can, therefore, be considered an ideal company profile that should contain the buyer and user personas within the company.

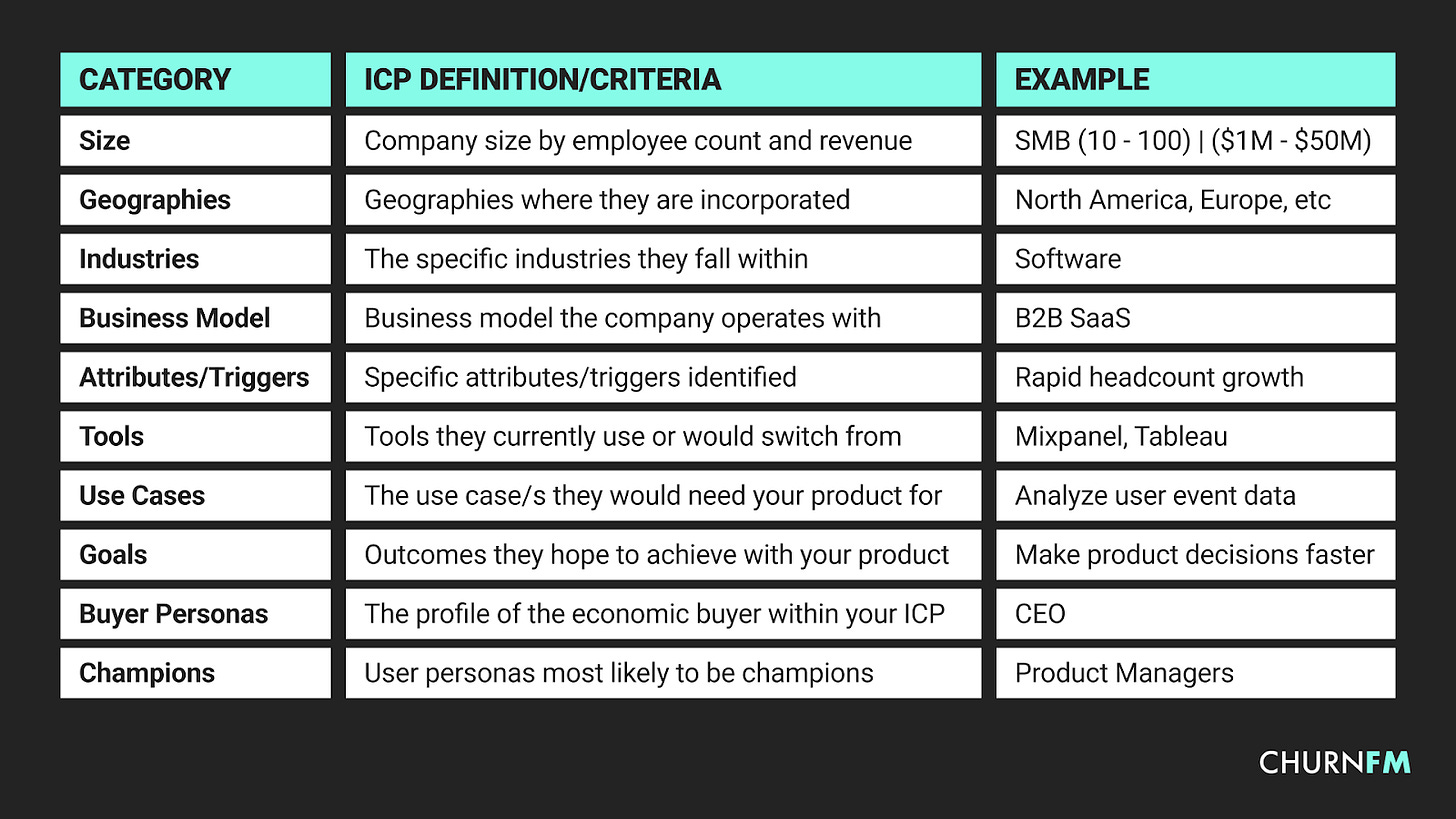

A good start in defining your ICP should contain some, if not all, of the following:

Size: Company size by employee count and revenue

Example: SMB (10 - 100 employees) | ($1M - $50M revenue)Geographies: Geographies where they are incorporated

Example: North America, Europe, etcIndustries: The specific industries they fall within

Example: SoftwareBusiness Model: The business model the company operates with

Example: B2B SaaSAttributes/Triggers: Specific attributes/triggers identified

Example: Rapid headcount growth or global officesTools: Tools they currently use or would switch from

Example: Mixpanel, TableauUse Cases: The use case/s they would need your product for

Example: Analyze user event dataGoals: Outcomes they hope to achieve with your product

Example: Make product decisions fasterBuyer Personas: The profile of the economic buyer within your ICP

Example: CEOChampions: User personas most likely to be champions

Example: Product Managers

Leah’s comment: I occasionally also include how many users inside of a company’s size can technically use your product. (Activatable users/seats) While that is often implied with the Size it’s often not the case if you have a very vertical product targetting only CFO’s for instance. Having a rough Idea what the % is of a fully activated account can help.

If you are extremely lazy and think about how to trim down this list then I think Size, Industry paired with the Use Cases are the absolute minimum to get started. It’s not enough but it’s better than nothing.

How to Identify Your ICP

Identifying your ICP is a triangulation exercise between quantitative, qualitative, and market analysis.

Quantitative analysis helps identify the most profitable and loyal customer segments.

Qualitative analysis provides a deeper understanding of customer needs and behaviors.

Market analysis ensures your ICP is aligned with industry trends and competitive dynamics.

Together, these methods enable you to define an ICP that not only reflects who your ideal customers are but also how to effectively reach and serve them.

The tools and methods of each type of analysis available to use differ when trying to identify your ICP by the stage of your company, and the further along you get with your journey, the more options you have available.

For this post and audience, we’ll focus on the growth stage encompassing all available methods and we will get started with quantitative analysis.

Leah’s comment: This is just a great chart and it visualizes one thing above anything, a lot of validation on the quantitative side only opens up once you have reached Product-Market Fit.

You need enough data to perform some of these methods but Qualitative methods never become irrelevant

Quantitative Analysis

Before diving into quantitative analysis, it’s important to highlight the need for good enrichment data and consistent segmentation.

When users sign up for our products, we typically collect some form of firmographic and use case data, but it is often not enough to build an ICP. That’s where enrichment steps in.

Services such as Clearbit, Zoominfo, and Clay allow you to enrich your CRM data that can then be used to segment your customer base by various attributes such as company size, revenue, tech stack, geography, and a lot more... giving you a better view of the makeup of your customer base and the properties shared by your ideal customers.

As you collect customer data through many places such as surveys, customer interviews, lead and signup forms and combine it with enrichment data it is important to set standardized segments within the properties.

For example, the firmographic property Company Size can be segmented in many ways, e.g.

1 - 10 people

11 - 100 people

OR

1 - 100 people

Standardizing your segments within the properties across your data sources allows you to cross-reference your findings across your research.

So once you have enriched your customer profiles and standardized segmentation you can start diving into some data analysis to answer some of the following questions.

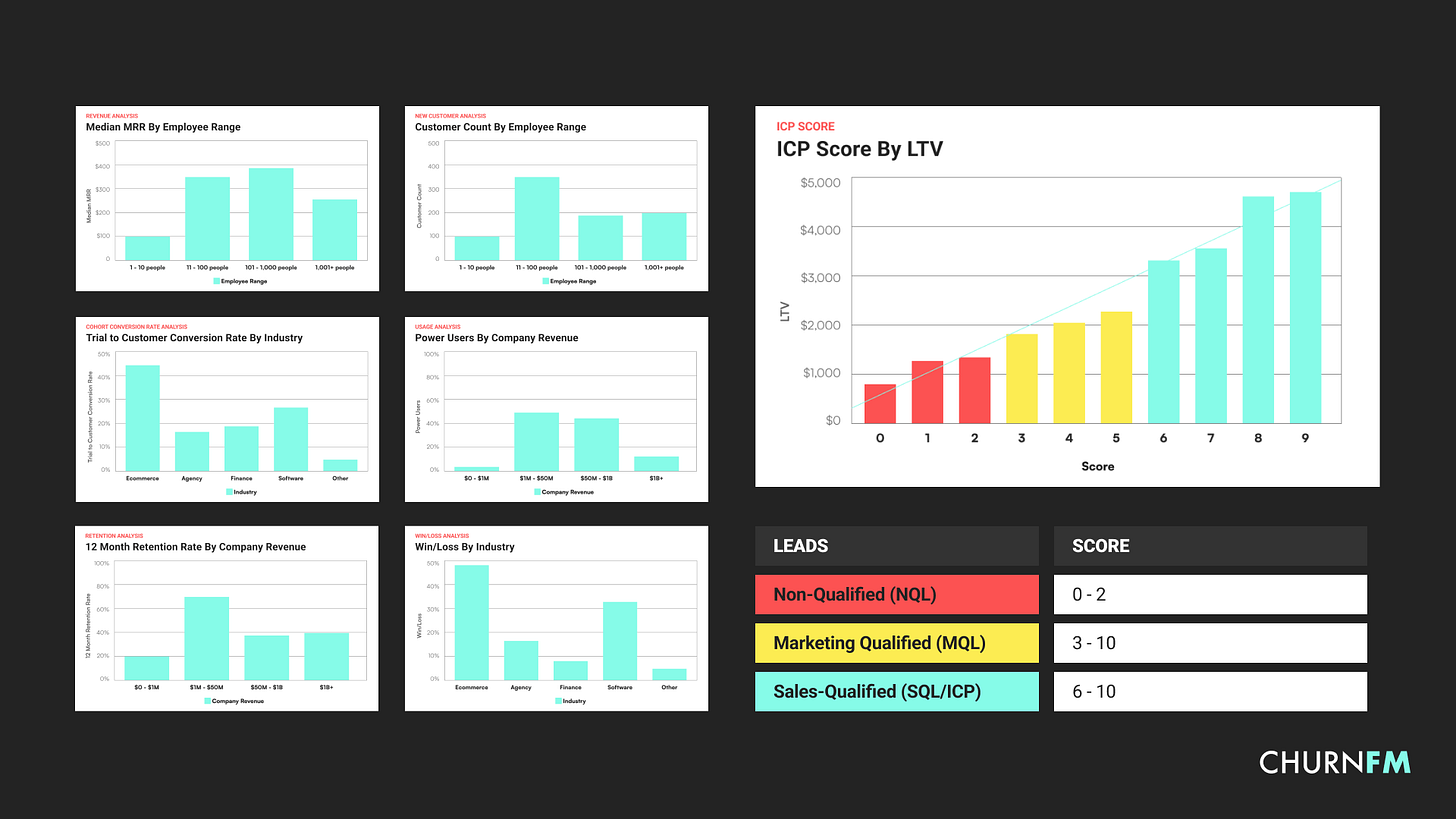

Cohort Conversion Rate Analysis

Who converts best through self-serve channels?

New Customer Analysis

Who is your marketing speaking to now?

Retention Analysis

Who sticks around for the long term?

Revenue Analysis

Who spends the most?

Usage Analysis

Who is extracting the most value from your product?

Win/Loss Analysis

Who converts best and fastest with the least friction in sales?

For each of these types of analysis, you want to break down the results by each of the properties in your enriched customer profiles to determine if any of the properties stand out.

Once you have the results you can assign scores to the properties that perform best across the analysis that can ultimately be used to develop an ICP scoring model to understand to what degree a customer is an ICP fit.

It is important to treat your ICP on a scale and not in a binary fashion as there is potential to lose out on many opportunities due to issues with missing data or a strong fit falling short on a property due to the specific nature of their business.

Minimal Quantitative Analysis

A super MVP version of the above would be to define a segment of your current customers that have been with you for over 12 months, spend more than your average customer, and have been active within the last 30 days.

Running the analysis on this audience will be a good starting point and in many cases may get you 90 - 95% of the way there to allow you to dive into some qualitative analysis with an audience in mind.

Qualitative Analysis

Once you understand which audience is most valuable from a quantitative perspective, you can layer on additional insights through qualitative research to uncover additional insights and behaviors of your ICP.

User Interviews

Who would be highly disappointed if they could no longer use your product?

What are their primary use cases?

Panel Studies

How does the market perceive your product?

Who values it the most with their willingness to pay and likelihood to buy?

Review Sites

What is the sentiment of your product by company size and roles?

What are the main pain points your users face?

What is the main value they derive?

Market Analysis

Finally, once you understand who your ideal customers are from a quantitative and qualitative perspective, it is important to validate the opportunity from the market perspective too.

Your customers are a direct result of the marketing you have done and the product you have built to date but they don’t necessarily represent the best opportunity for your business long-term.

Your ICP cannot be your ideal customer profile if you’ve saturated the market or if there‘s a trend working against them that would prohibit their long-term growth.

For example, in the late 90s, it would have been a mistake to define your ICP as a VHS rental company when the whole industry was on the way out, even if they made up the majority of your current customer base. That would have been a blockbuster mistake.

It is important to understand where the market is heading so that you can meet your ideal customers there.

A few places you can get started with market analysis are:

Market Reports

Where is the market today?

Where is the market moving tomorrow?

Google Trends

What is trending in your market?

Is your category interest growing or trending down over time?

Is there a surge in interest around specific roles that fall within your ICP?Competitive Analysis

Who is targeting your ICP?

What is your key differentiator for your ICP?

Social Media Analysis

What is the general sentiment about your market?

By triangulating insights from your quantitative, qualitative, and market analysis, you can get the best picture of who your customers serve today and how you can meet them where they are going tomorrow.

When should you define an ICP

The best time to start defining your ICP is now, and you’re always far better off getting started with something than continuing to aimlessly build for everyone. Get started with version 0.1 if you have to, but make sure you get started.

Defining your ICP is not a set-and-forget exercise

In an episode of Churn FM, Hiten dropped this quote, which has stuck with me since.

“Product-market fit is a moving target as the market is constantly evolving.”

It hit me as this adds another layer of complexity into this elusive state that every startup chases, and specifically in tech companies the rate of change today is on a whole other level.

This is important as it directly impacts your ICP as it is a part of the Market that is constantly evolving and therefore your ICP should be evolving with it.

Defining your ICP is not a set-and-forget exercise, and you should be constantly refining and, in some cases, redefining it entirely as you gain a new understanding of the market and your customers.

On top of the market evolving, you also need to be conscious of Everett Rogers, Diffusion of Innovation, and understand at which stage of the cycle your product is as your ICP can and, in most cases, should change as you progress through each stage of the cycle.

How to use your ICP

Your ICP is an excellent tool to keep your team aligned.

It allows them to prioritize their efforts on a core audience, create targeted marketing campaigns, inform product development, and enhance the sales experience and customer service.

Your ICP should not be used as an excuse to deliver a sub-par experience to everyone else or dismiss valuable feedback from outliers.

You should be constantly balancing your ICP focus with the overall market dynamics and company goals.

During my time at Hotjar, I led the exercise to define our initial ICP and the sequential updates we made along the way.

Hotjar operates in a hyper-competitive market where everybody is after everyone else’s lunch money. The number of Heatmap, Session Recording, Feedback, and Analytics tools grows day by day, and they’re all after building the full-stack insight suite.

Tools that started with Analytics are rolling out session recordings, and others that began with Feedback are introducing Heatmaps. The pattern will continue until there is no differentiation in the space as they all converge on the same product roadmap.

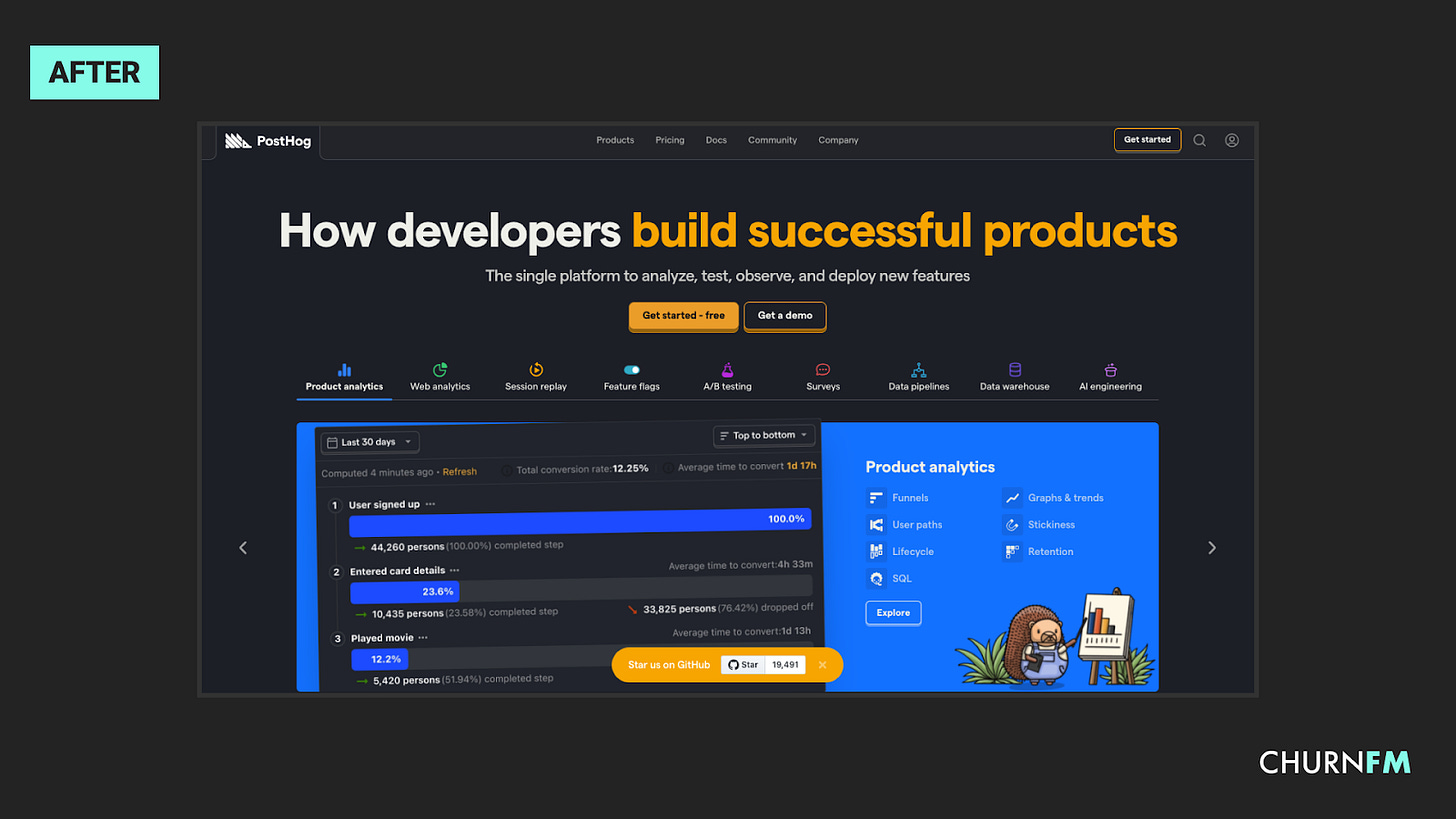

So when PostHog entered late in the game it was an uphill battle to break into the market and differentiate themselves. They gained some initial traction when launching on HackerNews by focusing on the open-source nature of the product but it wasn’t until they did the work to define their ICP that they took off.

PostHog realized that startups with product-market fit scaling up with new customers, hiring, and adding revenue were their ideal customers. They decided to build for the power users of product teams and doubled down on product engineers specifically. Once they had discovered their ICP, they went all in on them.

Some of the decisions they made because of this included:

An engineering-led culture

Selling features, not benefits

Transparent, usage-based pricing

Being product-led with no outbound sales

A UI that feels like a dev tool, not an analytics tool

A focus on high-quality content for engineers and founders

Not running advertising cookies and retargeting campaigns

An unconventional website full of code snippets and memes

Building dev-focused features (e.g., dark mode, SQL querying, data warehouse)

What you can expect when you use your ICP

The results then speak for themselves. PostHog experienced a step change in growth once they started to prioritize revenue and focused on creating and serving their ICP.

Aligning your team around an ICP is one of the single biggest high-impact activities you can do as a company to reduce churn and accelerate growth.

Course Announcement

Andrew and I launched a course, “How to find your Ideal Customer Profile 'ICP' in B2B SaaS,” and it’s live now! And you’re the first ones to know about it.

Since this is our first iteration, we’re giving 30% off the price; subscribe to it or get on the waitlist for future cohorts, now:

→ More information and register

Follow Andrew for more:

Finally, this is my first guest post on Substack. If you want to hear more from me, you can subscribe below: