How to be a commercial PM

Why reliability beats optimism in your roadmap

Do you, a B2B SaaS product, want to sponsor this spot so it’s free forever and get your message out? Drop us a line for the Mediakit: sponsoring@productea.io

One of the hardest concepts as a product manager is to step out of this notion to ship products and to be “commercial” or more “strategic”.

I heard this phrase directed to me as well a couple of times, and I never really knew what it meant or how to achieve these expectations from my higher-ups.

I’ve developed over the years my own methods in how to deal with it and use this framework more or less the same in coaching and when I set expectations towards my product managers and their teams.

The first step is to get a grip on your roadmap. It’s the one document that is your business card towards managing up, sideways, and down. It’s your master plan for what matters going forward.

It needs to be simple to communicate, easy to understand, honest, and as reliable as possible.

It may feel that most managers will push you in your career towards committing to things that are insane just to satisfy their own higher-ups. More often than not, this dynamic is caused by a frustration from management that they can’t rely on promises from the product, and because they are measured on what a PM delivers (in terms of business impact), they have only one option:

Micromanagement or building pressure to ship something because missed deadlines never make money, but shipping something might.

A good roadmap is a critical tool to build the trust with leadership that you have your area under control and that when you say “this is not going to work,” they believe you, instead of challenging you.

That’s easier said than done and an exercise that takes time. The first step, though, is to understand two key components of communicating any plan to management:

Reliability always beats Optimism.

Being proactive vs. reactive creates reliability over time.

Let’s map out what the three areas are that you have to cover, and some general tips on how to combine and communicate them.

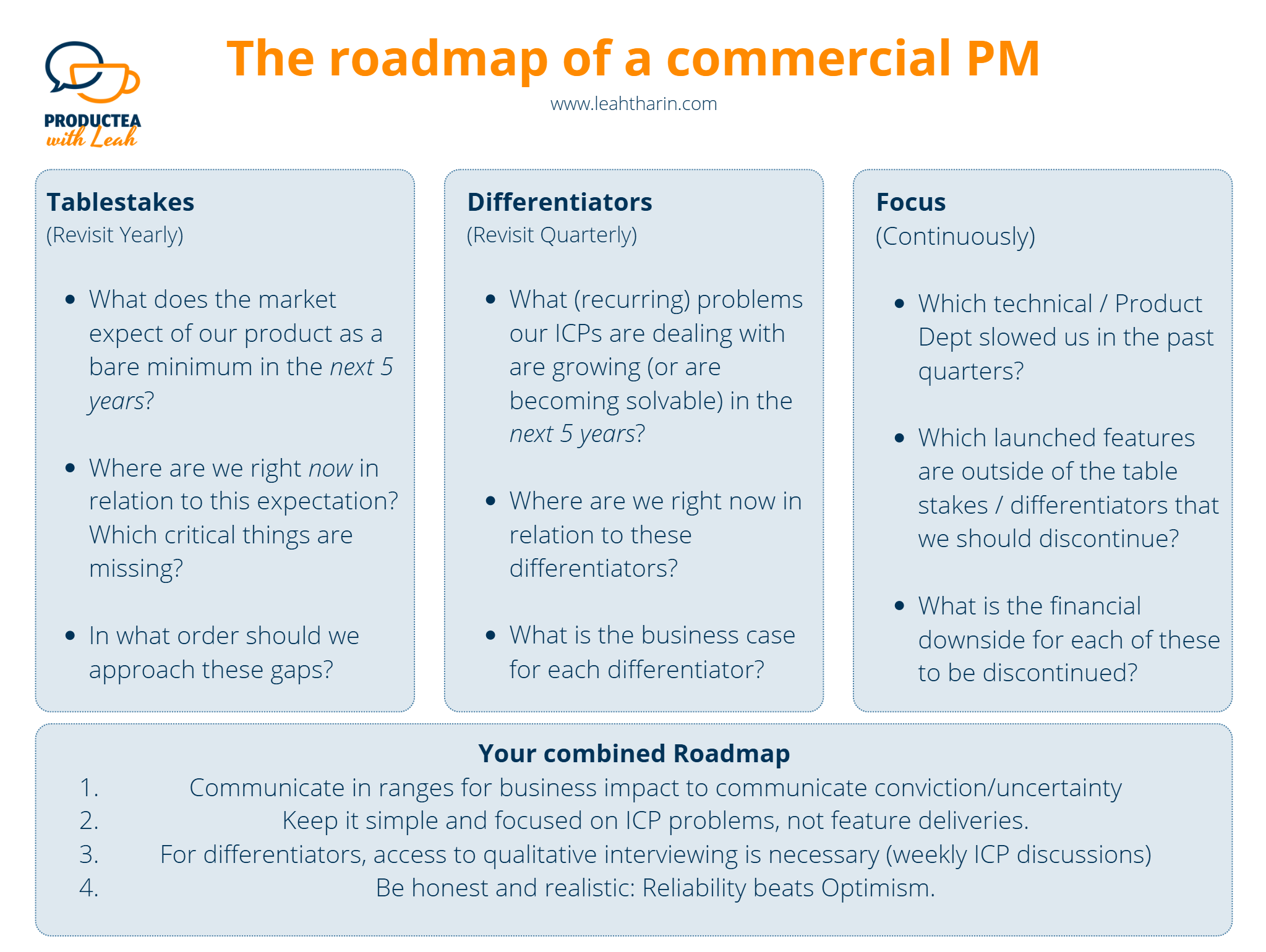

The roadmap of a commercial PM

The table stakes - What’s the minimum to participate in a market?

How to identify table stakes

What metrics do they typically move

The differentiators - What’s helping to stand out and sell?

How to identify differentiators

What metrics do they typically move

The focus - What keeps us from shipping on time?

Accountability for past commitments

Debt - Accept or pay back?

An opinionated, high-level roadmap

Communicating in ranges

Honesty vs. optimism

Simplicity in complex topics

Let’s look at each one in more detail:

1. Table stakes

Table stakes are things that the market expects of your product to be present to be considered as a bare minimum. I highly recommend that you think of table stakes not in the context of today, but whether those hold up in the next couple of years.

Remember that what we build needs to sell in future markets for some time to be commercially viable, not just today.

It’s important to understand the difference between table stakes and differentiators. Table stakes do NOT make us buy a product. Table stakes are simply what define a product inside a category.

A table stake for a car, for instance, is that it has four wheels, can drive, and is compliant with the regulations of the country in which it is released. None of these factors gets a customer excited to buy it; it’s simply necessary to recognize it as a car.

Things that used to be exciting for people become table stakes with time, as everyone else is copying them. We see this right now because of AI that a lot of functionality is simply expected to be present (AI summarization or some kind of LLM integration), whereas 2 years ago, the same features were the reason why customers bought your product over another one. (Which would be a differentiator)

In general, try to remember that table stakes are not something that we use to wow our customers; they are simply an expectation, therefore, the commercial impact of them is limited when it comes to acquiring new customers.

There’s an important exception to this: If the core functionality of your product is in an extremely bad shape and you’re not fulfilling your table stakes at all, you will influence new customer acquisition.

In other words, your company lost or never had product market fit, this only happens in earlier start ups or established companies that fall prey to the red queen effect (a continous deterioration of market conditions)

If that is the case, your roadmap should ONLY contain tablestake items until they are sorted out.

Commonly, you positively influence the following metrics by ensuring table stakes are in order:

Any 30day+ retention

LTV (Lifetime Value)

Support tickets

Overall customer sentiment

Churn

Three questions to table stakes:

“What does the market expect of our product as a bare minimum in the next years?”

To answer this question, you should have a hypothesis on what you believe is stable and what’s changing in the market where your product is sitting. Zoom out for this one, trends can be in quarterly reports of competitors, your company strategy, market reports, or by simply developing a sense from talking to ICPs (Ideal Customer Profiles) outside of your product. Make sure you validate your views here with leadership.

We’re looking here for macro trends that have or could have a broader impact on the market.

For instance, if you believe that PDFs are getting replaced by a different document format (for your ICPs), why are you building out complex functionality for a bulk importer that is compatible with PDFs?

A common mistake here is to focus too much on your company, existing customers, and product. Trends are shaped in the market, not your existing customer base. Talk also to people who are not your customers but fit your Ideal Customer Profile. If leadership has a bet on future trends, ask questions until you understand why they believe them.

This is the very foundation of everything that follows. A commercial PM has high conviction and understanding of how the market looks and bases all assumptions on that, nothing else.

“Where are we right now in relation to this expectation? Which critical things are missing?”

Now, we do an honest positioning of our product. Where are we today?

Since we developed an understanding of where the market is going or staying, we can highlight the gap between where we are and where the market is going.

Now we can list critical table stakes that need work to be ready or that are simply missing based on this difference.

Make sure that you’re not overfocusing on features here that are easy to communicate. This can also be on softer factors like reliability which are harder to identify.

As markets stabilize, customers expect more reliable services. In the early days of AI, it was expected and accepted that LLMs hallucinate. Depending on what you offer, this might not be the case anymore in one or two years.

For instance, if we see the volume of frustrated ICPs (internal support tickets, general sentiment in calls, public reviews) increase when it comes to how well core functionality works, then this hints at a table stake we have to be ready for.

I also recommend aligning what you find with leadership first before you communicate a finalized roadmap.

“In what order should we approach these gaps?”

I cannot stand it when PMs approach me with lists of opportunities and table stakes that are not stackranked. Sorting everything we have to do in “High,” “Medium,” and “Low” is not good enough.

Have an opinion on why you believe that every item is more important than the next. Yes, we can often develop things in parallel, but even then, I’d like to know what’s at the absolute top of your list.

Anything we develop is a combination of two things:

The opportunity it presents

The cost (time and money) it incurs to develop and ship it

The combination of those two should already dictate what gets to the top of your list. For instance, a lot of PMs believe that only things that require a lot of work (High Cost) are worth being mentioned to leadership.

This leads to products that can’t get their basics sorted out (being easy to use, reliable etc.) while stuck in developing only complex stuff.

This happens because often, low-cost, high-impact things to do are hard to quantify and less sexy to communicate.

I generally try to visualize anything we do on a 2 x 2 with the above in mind to remind people what we look for when we talk about table stakes:

You might be wondering why I prioritize low-cost / low-impact over high-impact / high-cost ideas for table stakes.

This has to do with the fact that we commonly underestimate high-cost items in terms of time and money, which delays their impact as a consequence. A lot of PM careers were cut short because of ideas that spiraled out of control over multiple quarters and took up their entire attention, neglecting other, more basic things.

If you have a strong conviction for a high-cost / high-impact table stake that you want to develop, find a way to reduce the cost as much as possible. This is commonly done by introducing measurable milestones (splitting the opportunity up) that serve as checkpoints to determine whether we should abort or continue spending resources on something.

(As in, having multiple smaller throws that make up the big one in total)

In summary, there are two conditions under which you take care of high-cost / high-impact table stakes:

You have exhausted all other low-cost opportunities

The market forces you to take care of them (see Red Queen article above) because otherwise you won’t survive long term

Commonly, table stakes tend to be relatively stable, and you should be fine revisiting them once a year (or whenever a new company strategy is formed).

The trap of being data-driven and table stakes

The most challenging aspect of addressing table-stakes problems is that forming a business case for them in hard numbers is often seemingly impossible and unappealing. That’s why we spend a lot of time getting alignment on the trends and the current state of our product first.

For instance, we might agree with leadership that our interface looks like absolute crap and customers expect more from us compared to what others are getting done. To express that problem in hard numbers is almost impossible.

The underlying buy-in can only come from a shared conviction that this is more important than other flashy things on the road map, based on trends and customer sentiment.

Having said that, this is not a free pass to do everything without any data. If you cannot find a single customer who has a serious issue with what you’re saying is the problem, then you probably are not solving something worthwhile (see more details in the next chapter in how to create a business case)

2. Differentiators

People and companies do not buy new services for problems that are only marginally better than what they already have as a workaround or solution.

A differentiator is an opinionated specialization that you do better than anyone else to create this margin. It allows your company to move upmarket and charge more money per customer.

If a prospect is looking for a solution to a problem they encounter, they start weighing different solutions against each other on a comparison sheet.

In order to get on that mental comparison sheet, we need to fulfill the table stakes.

In order to be selected over the other options a customer considers, we need to have them experience relevant differentiators.

We commonly talk about this in Jobs theory as an underserved need.

A “need” is defined by table stakes: “I need to get from A to B (with a car)” (this would be a table stake)

Underserved means the current solution is not good enough in solving this need in some way, and could be anything:

“My current car is too expensive.”

“My current car is too loud on long drives.”

“My current car is not spacious enough when I pack my things.”

etc. etc.

Your job is to find out which one of these underserved needs is relevant enough in high enough numbers for your ICPs so they are worth addressing in the next years and where you are positioned today in relation to them.